Toronto-Dominion Bank (TD), Canada’s largest bank by total assets, will report Q2 earnings on May 27 before the opening bell. Over the past year, the stock has jumped by approximately 60% and is currently trading close to C$90.00. Solid earnings could propel shares of TD higher, so let’s have a look at what analysts are expecting.

Analysts on average, expect TD to post adjusted earnings of C$1.76 per share in Q2 2021, representing a growth of 107% from the prior-year quarter (C$0.85 per share). The estimated revenue is C$10.27 billion, indicating a decrease of 1.1% from the second quarter of 2020 (C$10.53 billion).

TD beat EPS estimates in the past two quarters and is expected to beat estimates again in the coming quarter.

Factors to watch

Equity markets experienced a higher level of activity during the latest quarter, along with increased volatility, driven by continued uncertainty over economic growth. In addition, inflation concerns did not curb strong fixed-income markets. Therefore, revenues from the company’s equity and fixed income markets are expected to improve in Q2.

Meanwhile, TD boosted its reserves during the deteriorating macroeconomic environment last year. It is unlikely that the bank will need to increase the provision for loan losses in Q2. (See Toronto-Dominion Bank stock analysis on TipRanks)

A few days ago, Scotiabank analyst Meny Grauman reiterated a Hold rating on TD but raised its price target to C$95.00 (from C$91.00), for 7% upside potential. Grauman stated that Canadian banks can trade at higher multiples since their outlook is excellent.

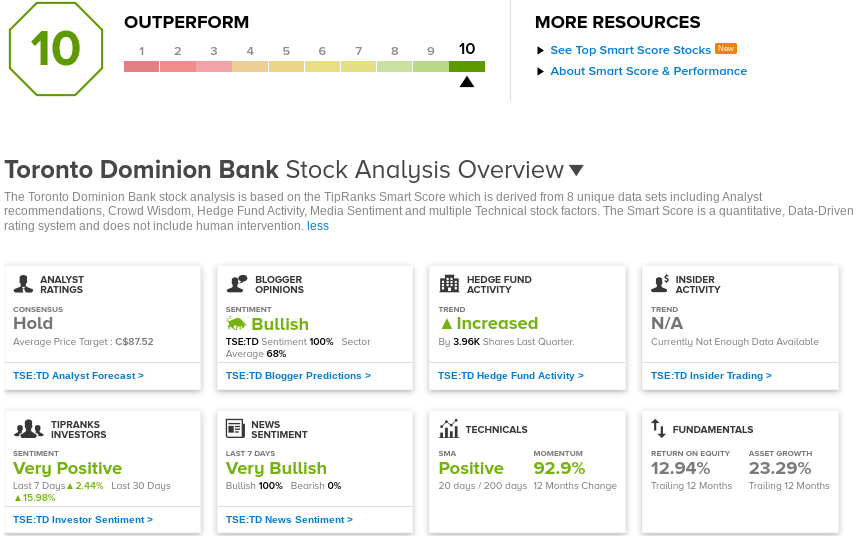

Overall, TD scores a Hold rating among Wall Street analysts based on 3 Buys, 6 Holds, and 2 Sells. The average analyst price target of C$87.52 implies 1.4% downside potential to current levels.

TipRanks’ Smart Score

TD scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform the overall market.

Related News:

BMO Earnings Preview: Here’s What to Watch for

CIBC Celebrates 10th Global Accessibility Awareness Day

Power Corp Q1 Profit Nearly Triples, Beat Estimates