American retail chain Target Corporation (NYSE: TGT) has outpaced the holiday season footfall compared to both its 2019 numbers and peers’ footfall numbers, according to Reuters. Shares jumped 1.7% on the news and ended that day up 1.1% at $231.35 on January 6.

Holiday Season Footfall

According to the report, data given by research firm Placer.ai showed that shopper visits from November 1 to December 25 for Target grew 6.2% compared to the pre-pandemic numbers. Meanwhile, data showed that peer Walmart Inc.’s (WMT) footfall fell 0.1%, and Best Buy Co. Inc.’s (BBY) in-store visits declined 11.5% compared to the pre-pandemic figures.

According to the report, pre-shopping and online shopping trends have also resulted in a fall in in-store shopping trends. With the pandemic, people have changed their shopping patterns, and have found convenience and affordability in the online shopping experience. This has adversely affected impulsive shopping, which accounts for about 25% of retailers’ holiday sales.

For Target, in-store traffic rose in every other state except Hawaii and Washington D.C. States like Vermont and Idaho witnessed an in-store footfall rise of almost 24% compared to their 2019 numbers.

Some of the reasons for Target’s increased store traffic can be attributed to a revamp in its stores. The retailer has added outlets like coffee chain Starbucks (SBUX) and Walt Disney (DIS), as well as salon chain Ulta Beauty (ULTA) to its stores, making them an attractive destination for shoppers. Target also focuses on curbside pickups and same-day delivery services that attract shoppers to the store.

Wall Street View

Yesterday, Wells Fargo analyst Edward Kelly downgraded the stock to a Hold rating from Buy and kept a price target of $230, which implies that shares are almost fully valued at current levels.

Overall, the stock has a Moderate Buy consensus rating based on 10 Buys and 5 Holds. The average Target price target of $281.87 implies 21.6% upside potential to current levels. Shares have gained 21.1% over the past year.

Hedge Fund Activity

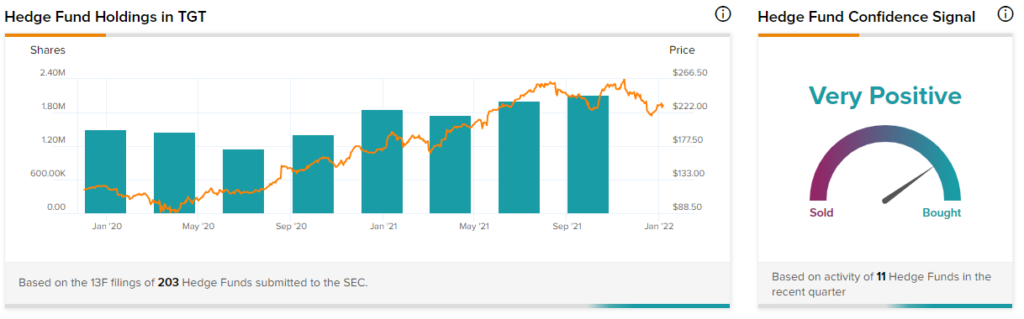

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in TGT is currently Very Positive, as 11 hedge funds increased their cumulative holdings of the stock by 102,700 shares in the last quarter.

Download the TipRanks mobile app now

Related News:

Walmart to Add 3,000 Drivers to Bolster InHome Delivery; Shares Rise

GM’s BrightDrop Secures Commercial EV Orders from Walmart & FedEx

Airbnb Users Ask for Crypto Rentals in 2022; Shares Down 5%