Susquehanna upgraded MercadoLibre to Buy from Hold as the company saw a surge in e-commerce growth and topped 2Q profit estimates.

Susquehanna analyst James Friedman lifted MercadoLibre’s (MELI) price target on to $1,300 (18.2% upside potential) from $630. Friedman believes “it is a good opportunity to participate as the company expands its lead in e-commerce and productizes its solutions in Fintech.”

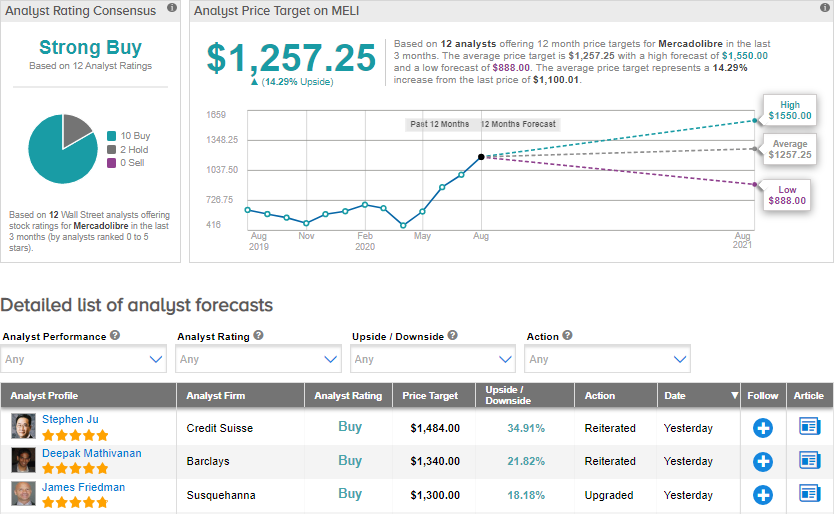

In addition, Credit Suisse analyst Stephen Ju raised the stock’s price target to $1,484 (34.9% upside potential) from $1,255 following the company’s 2Q financial results. Ju said, “MercadoLibre’s efforts to capture incremental share, with managed logistics network fulfillment penetration reaching 20% in Brazil in June, expanding category-specific pricing to Brazil and Argentina, and expanding Pago use cases such as utility payments and mobile top up.”

MercadoLibre reported 2Q earnings of $1.11 per share, crushing Street estimates of $0.09 per share. Its 2Q revenues jumped 61% year-over-year to $878.4 million, topping analysts’ expectations of $748.7 million, as the demand for online shopping surged amid the coronavirus crisis. The company’s unique active users leaped more than 45% year-over-year to 51.5 million.

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 10 Buys versus 2 Holds. The average price target of $1,257.25 implies upside potential of about 14%. (See MELI stock analysis on TipRanks).

Related News:

Canada Goose Slips 4% On Depressed 2Q Sales Outlook

Casper Sleep Beats 2Q Revenues; Shares Dip Over 10%

Nio Rising 8% On Record-High Quarterly Deliveries; But Street Cautious