Software and cloud solutions provider Splunk (SPLK) has agreed to acquire San Francisco-based TruSTAR. The terms of the deal have not been disclosed.

TruSTAR is a cloud-native security company that offers a data-centric intelligence platform.

The move will help Splunk expand its security solutions portfolio in the cloud. It will further enhance its security capabilities, enabling customers to effectively detect threats and respond to them more quickly and autonomously.

Splunk’s Senior Vice President Sendur Sellakumar said, “We’re excited to bring TruSTAR’s visionary, data-centric platform into our security offerings as Splunk continues to deliver best in class security capabilities for our customers.” (See Splunk stock analysis on TipRanks)

Following the acquisition announcement, Oppenheimer analyst Ittai Kidron assigned a Buy rating and a price target of $203 (75.9% upside potential).

Kidron said, “We believe the acquisition, combined with Splunk’s core log/performance monitoring solutions, expands its detection and response capabilities and can enable its customers to utilize data from third-party threat intelligence sources in an effort to reduce the average time to remediate security issues.”

He further added, “The addition of TruSTAR can accelerate Splunk’s effort to compete with emerging XDR solution providers, which have been increasingly viewed as an alternative to SIEM solutions. Overall, we view the acquisition as an incremental positive.”

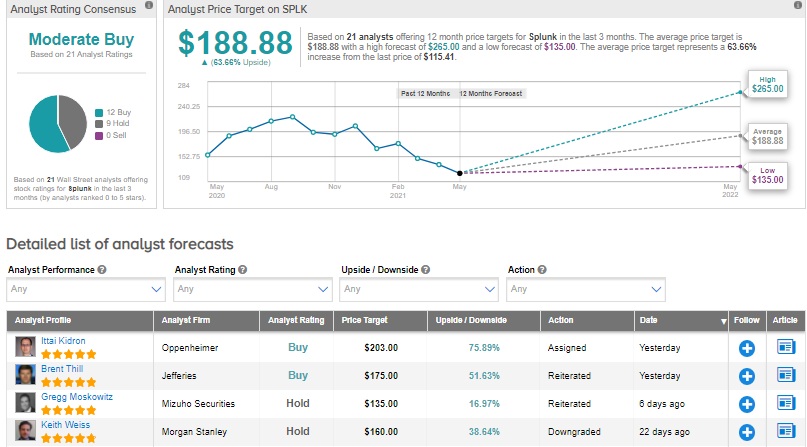

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 12 Buys versus 9 Holds. The average analyst price target of $188.88 implies 63.7% upside potential to current levels. Shares have decreased almost 27.4% over the past year.

Related News:

Black Knight Snaps Up eMBS, Expands Mortgage Portfolio

Hostess Brands Tops Expectations in Q1; Shares Fall

Graphic Packaging to Snap up AR Packaging for $1.45B; Shares Fall