Skillz Inc. (SKLZ) has reported a larger-than-feared loss in the third quarter of 2021, impacted by elevated costs and expenses. Additionally, revenues missed analysts’ expectations.

Following the news, shares of the online mobile video game platform dropped 10.1% in the extended trading session on Wednesday, after closing 7.1% higher on the day.

Skillz incurred a loss of $0.16 per share in Q3, compared to the loss of $0.14 recorded in the same quarter last year. Analysts had expected the company to report a loss of $0.14 per share.

Meanwhile, total revenue of $102.1 million surged 70% year-over-year but fell short of consensus estimates of $102.31 million.

Markedly, monthly active users (MAUs) came in at 3 million in the quarter, up 11.1%, while paying MAUs surged 47% compared to the same quarter last year. (See Skillz stock charts on TipRanks)

What’s more, Gross Marketplace Volume (GMV) jumped 49% year-over-year in the quarter, while gross margin was 93%, down 200 basis points. Total costs and expenses more than doubled from the prior-year quarter to $183.7 million.

In response to the third-quarter results, Skillz CEO Andrew Paradise commented, “Skillz delivered strong revenue growth for the third quarter of 2021 marking our 23rd consecutive quarter of revenue outperformance. The company was able to increase User Acquisition (UA) marketing investment to acquire new users…We achieved this improvement without meaningful benefits from our acquisition of Aarki, which we closed in Q3, as the migration of our advertising spend from third parties to the Aarki platform is still underway.”

Guidance

Looking ahead, Paradise said, “We remain focused on pioneering the competitive mobile gaming experience and connecting players in fair, fun, and meaningful competition. We will continue growing by investing in the technologies and creators that are the bedrock of our content pipeline.”

For 2021, the company reaffirmed the total revenue outlook of $389 million (inclusive of Aarki).

See Analysts’ Top Stocks on TipRanks >>

Analysts Recommendation

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating. That’s based on 3 Buys versus 2 Holds. The average Skillz price target of $20.00 implies 60.5% upside potential to current levels. Shares have increased 7.1% over the past year.

Bloggers Weigh In

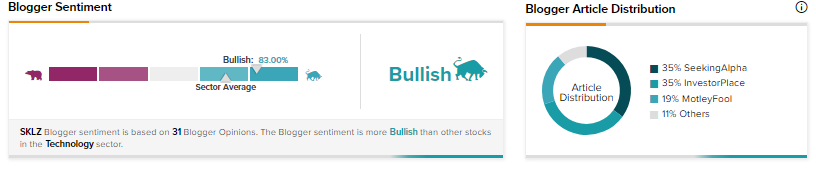

TipRanks data shows that financial blogger opinions are 83% Bullish on SKLZ, compared to a sector average of 71%.

Related News:

Novavax’s COVID-19 Vaccine Authorized in Indonesia; Shares Soar 16%

Chegg Drops 29% as Q4 Guidance Disappoints, Q3 Revenues Miss Estimates

Diamondback Books Better-than-Expected Q3 Profit, Boosts Dividend