Singapore Airlines (SINGF) announced on Monday that it has raised a total of S$10 billion ($7.17 billion) of liquidity, through a mix of secured and unsecured credit facilities, as well as a recent rights issue.

This airline is shoring up its finances as it grapples with the challenges the global coronavirus pandemic has brought on the aviation industry.

On 5 June, the airline raised S$8.8 billion through the completion of its rights issue. Another S$900 million was generated through long term loans secured on some of the airline’s Airbus (EADSF) A350-900 and Boeing (BA) 787-10 aircraft.

In addition, the company has secured new credit lines and a short term unsecured loan with several banks, which provide further fresh liquidity amounting to more than S$500 million.

“We are grateful for the strong support of our shareholders for our successful rights issue, which has secured the company’s future amid an unprecedented global health and economic crisis,” Singapore Airlines CEO Goh Choon Phong said. “SIA will remain steadfast and agile during this period of great uncertainty, and continue to act nimbly in responding to the evolving market conditions.”

Furthermore, all of the airline’s credit lines that were due to mature during the course of this year have been renewed until 2021 or later, thereby ensuring continued access to more than S$1.7 billion in liquidity.

Commercial airline travel has fallen off a cliff due to coronavirus-induced lockdown restrictions forcing many airlines around the world to ground the majority of their fleets, sharply reduce spending and bump up their finances to cope with the financial fallout.

“During this period of high uncertainty Singapore Airlines will continue to explore additional means to shore up liquidity as necessary,” the company said in a statement.

Looking ahead the airline said that for the period up to July 2021, it also retains the option to raise up to another S$6.2 billion in mandatory convertible bonds, to provide additional liquidity if necessary.

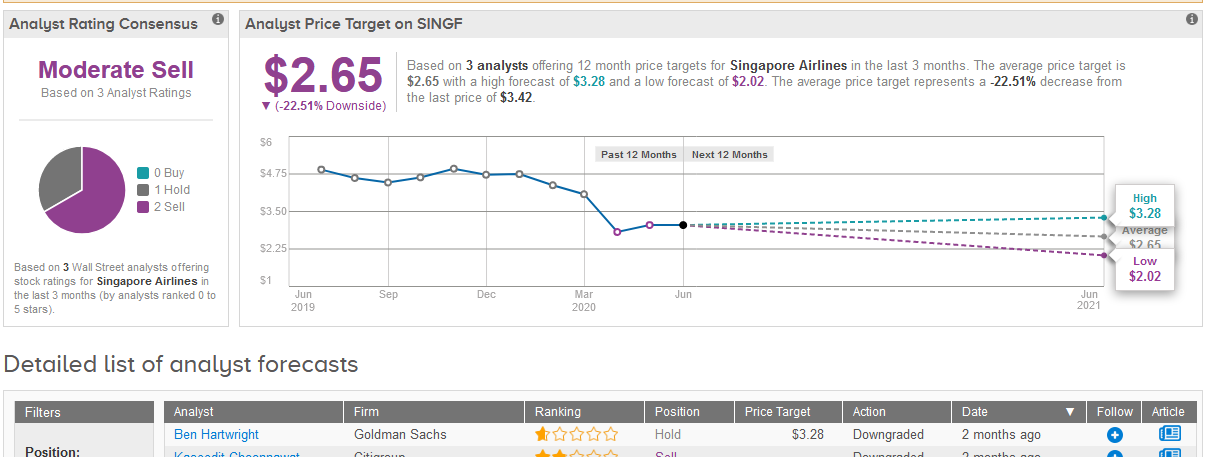

Goldman Sachs analyst Ben Hartwright at the end of May cut the airline’s rating to Sell from Neutral.

“If traffic remains sluggish, earnings continue to disappoint, and funding pressures rise, the shares will likely underperform,” Hartwright wrote in a note to investors.

Shares rose 2.7% to close at $3.42 on Friday after losing as much as half of their value since the beginning of this year.

Wall Street analysts are bearish on the stock with a Moderate Sell consensus. The $2.65 average price target implies 23% downside potential in the shares in the coming 12 months.

Related News:

Airbus Gets No New Aircraft Orders In May Amid Aviation Crisis

Boeing CEO Says ‘Likely’ A Major Airline Could Fold In 2020

Colombian Carrier Avianca Files for Bankruptcy Protection Due to Coronavirus Woes