Shares of Sesen Bio dropped 4.5% in early trade on Monday after the late-stage clinical company reported fourth quarter results that were in line with analysts’ expectations.

Sesen Bio’s (SESN) 4Q loss of $0.11 per share met consensus estimates. Meanwhile, the loss declined compared to the prior-year quarter’s loss of $0.32 per share.

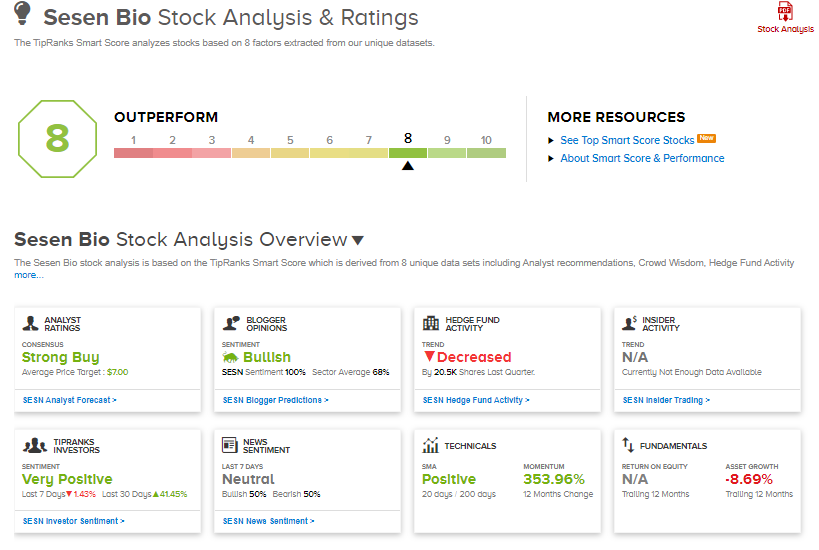

Research and development expenses increased 3.7% year-over-year to $5.6 million, while general and administrative expenses rose 3% to $3.4 million. (See Sesen Bio stock analysis on TipRanks)

Additionally, Sesen Bio announced that its lead program, Vicineum, also known as VB4-845, is currently in the follow-up stage of a Phase 3 registration trial, which is designed for the treatment of BCG-unresponsive non-muscle invasive bladder cancer (NMIBC). Notably, in February, the company’s Biologics License Application (BLA) for Vicineum was accepted by the Food and Drug Administration (FDA) for filing under priority review.

Sesen Bio CEO Dr. Thomas Cannell commented, “With a strong balance sheet and clear regulatory path forward in both the US and Europe, we are positioned to fully realize the potentially significant global opportunity for Vicineum.”

“We expect 2021 to be a transformative year for Sesen Bio and the patients we serve,” Cannell added.

On Feb. 17, Canaccord analyst John Newman increased the stock’s price target to $7 (153% upside potential) from $5 and reiterated a Buy rating.

Newman noted that Vicineum received priority review from the FDA which he now sees gaining approval in 3Q21.

Additionally, the analyst views his price target as conservative as Vicineum could price four times higher than his estimates.

Sesen Bio shares have exploded 164.8% over the past six months and scores a Strong Buy consensus rating based on 3 unanimous Buys. That’s alongside an average analyst price target of $7.

What’s more, Sesen Bio scores an 8 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Franchise Group’s Fiscal Year 2021 Outlook Beats Estimates After Surprise 4Q Loss

Asana Posts Smaller-Than-Expected Quarterly Loss As Sales Outperform

Dick’s Sporting Goods’ Quarterly Profit Pops 84% As Online Buying Booms; Shares Sink