ServiceNow, a software company, has agreed to snap up India-based Intellibot, a robotic process automation (RPA) company. The financial terms of the deal were not disclosed.

ServiceNow’s (NOW) Creator Workflow Products SVP Josh Kahn said, “ServiceNow is the platform of platforms for the workflow revolution, offering powerful end‑to‑end automation capabilities that allow customers to streamline business decisions and unlock new levels of productivity.”

Intellibot extends ServiceNow’s core workflow capabilities by aiding customers in automating the repetitive tasks for intelligent, end‑to‑end automation, the company said.

With this acquisition, ServiceNow seeks to integrate Intellibot’s capabilities into the Now Platform, which will help in integrating with both modern and legacy systems. This, in turn, will enhance productivity and strengthen the current artificial intelligence (AI) and machine learning (ML) efforts. The acquisition is anticipated to close in the second quarter of 2021.

Recently, the Now Platform Quebec Release was delivered, with it designed to enable enterprises to speed up their digital transformation and enhance productivity. The company expects Intellibot to complement these capabilities. (See ServiceNow stock analysis on TipRanks)

Per ServiceNow, the Indian market is one of the company’s fastest-growing markets, and, therefore, it plans to develop two new data center facilities in India by the first quarter of 2022. Notably, along with fulfilling the local data residency requirements, these centers will form part of ServiceNow’s advanced architecture and will continue to maintain the scalability of the company’s cloud services. The company also plans to increase its employee base significantly in the country within the next three years.

Following the acquisition, Needham analyst Jack Andrews reiterated a Buy rating and the price target of $595 (24.4% upside potential) on the stock.

Andrews said, “The acquisition will bring RPA and low-code together in a single platform comparable to other vendors in software, and thus should provide further leverage for NOW to address some of the fastest-growing segments in enterprise software, as we believe more organizations are looking for emerging automation features following the pandemic.”

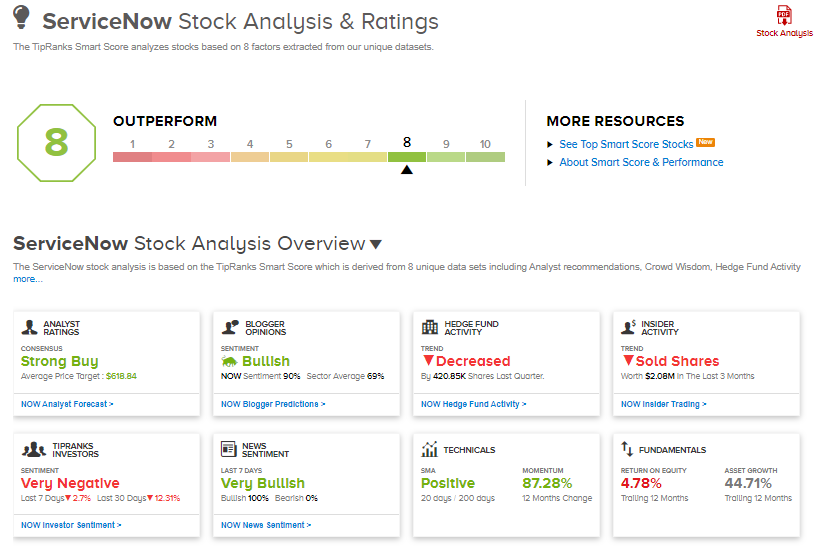

Shares have exploded 75.8% over the past year, while Wall Street analysts are still bullish about the stock. The Strong Buy consensus rating boasts 18 Buy ratings versus 1 Hold rating. Looking ahead, the average analyst price target stands at $618.84, putting the upside potential at 29.4% over the next 12 months.

On top of this, ServiceNow scores an 8 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Ametek Inks Deal To Acquire Abaco Systems For $1.35B

Embraer Posts Smaller-Than-Feared Quarterly Loss; Shares Pop 7%

FDA Accepts New Drug Application For Bristol Myers Squibb’s Mavacamten