Satsuma Pharmaceuticals reported a larger-than-expected loss in the fourth quarter. Shares of the clinical-stage biopharmaceutical company rose 4% to close at $5.73 on March 25.

Satsuma (STSA) incurred a loss of $0.72 per share in 4Q, compared to the $0.53 loss per share estimated by analysts. The reported loss also widened from the prior-year quarter’s loss of $0.62 per share.

The company’s research and development expenses decreased 2.2% on a year-over-year basis to $9 million in the quarter, while total general and administrative expenses surged 62% to $3.4 million. (See Satsuma stock analysis on TipRanks)

Satsuma CEO John Kollins said, “Our team remains steadfast in its commitment to developing STS101 as an important and differentiated acute treatment option for people living with migraines and to initiating a new Phase 3 efficacy trial this summer.”

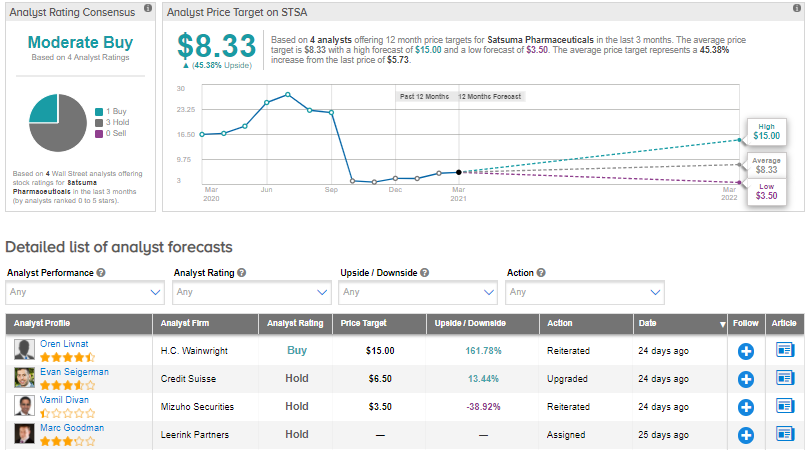

On March 2, H.C. Wainwright analyst Oren Livnat increased the stock’s price target to $15 (161.8% upside potential) from $7 and maintained a Buy rating.

Livnat said, “Learnings from EMERGE, and new funding, provide path for another good Phase 3 shot on goal.”

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 1 Buy and 3 Holds. The average analyst price target of $8.33 implies 45.4% upside potential to current levels. Shares have jumped 25.4% so far this year.

Related News:

Exelixis Partners With Merck KGaA And Pfizer For STELLAR-001 Clinical Trial

FDA Accepts New Drug Application For Bristol Myers Squibb’s Mavacamten

ServiceNow Inks Deal To Acquire Intellibot, Boosts Automated Workflow