Restaurant Brands International (QSR), the parent company of Burger King, Tim Hortons, and Popeyes, will report its third-quarter financial results on October 25 before the opening bell.

Over the past year, the stock has returned 0% and is currently trading close to C$76. Strong earnings could boost Restaurant Brands’ shares, so let’s have a look at what analysts are expecting.

Analysts on average expect Restaurant Brands to post earnings of C$0.94 per share in Q3 2021, compared to earnings of C$0.68 in Q3 2020. Estimated revenue is C$1.95 billion, representing an increase of 45.5% from the prior-year quarter (C$1.34 billion).

Restaurant Brands beat earnings estimates in the past two quarters, but it might not beat them in the coming quarter.

Points to Watch

Restaurant Brands’ continued improvement in system-wide global sales and comparable sales likely benefited third-quarter 2021 performance.

Quality food, the rapid adoption of digital channels by customers, and the acceleration of new restaurant openings around the world by its franchisees are expected to have driven the company’s performance.

Additionally, revenue is expected to have been driven by strong brand-building efforts, and a rapidly growing business model.

On the other hand, the pandemic has likely impacted Restaurant Brands’ financial performance to some degree in the third quarter. The restaurant industry has been facing lower traffic for some time now. (See Analysts’ Top Stocks on TipRanks)

On October 20, RBC Capital analyst Christopher Carril reiterated a Buy rating on QSR and a price target of C$74. This implies 2.9% downside potential.

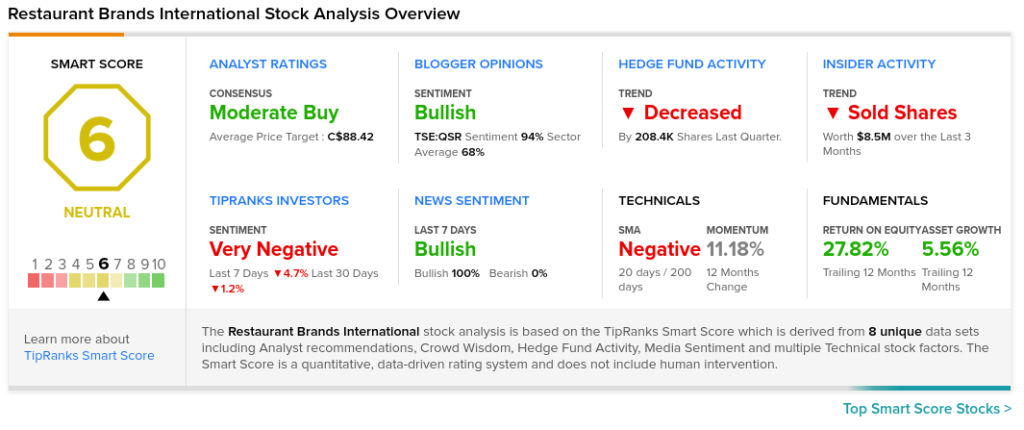

The rest of the Street is cautiously optimistic about QSR, with a Moderate Buy consensus rating based on nine Buys and six Holds. The Restaurant Brands International price target of C$88.42 implies 16% upside potential to current levels.

TipRanks’ Smart Score

Restaurant Brands International scores a 6 out of 10 on the TipRanks Smart Score rating system, indicating that the stock returns should be in line with the overall market.

Related News:

MTY Signs Deal with Küto Comptoir à Tartares

Couche-Tard Q1 Revenue Rises 40%, Beats Estimates

good natured Products Inc. Q2 Sales Rise 237%