Raytheon Technologies Corporation (RTX) has inked a strategic collaboration and licensing agreement with GLOBALFOUNDRIES (GF) to enhance future wireless networks. The two are joining forces to develop and commercialize a new gallium nitride on silicon semiconductors to enhance frequency performance on 5G and 6G.

Raytheon is a defense and aerospace company that provides advanced systems and services for commercial, military, and government customers worldwide. GLOBALFOUNDRIES is a worldwide semiconductor manufacturer.

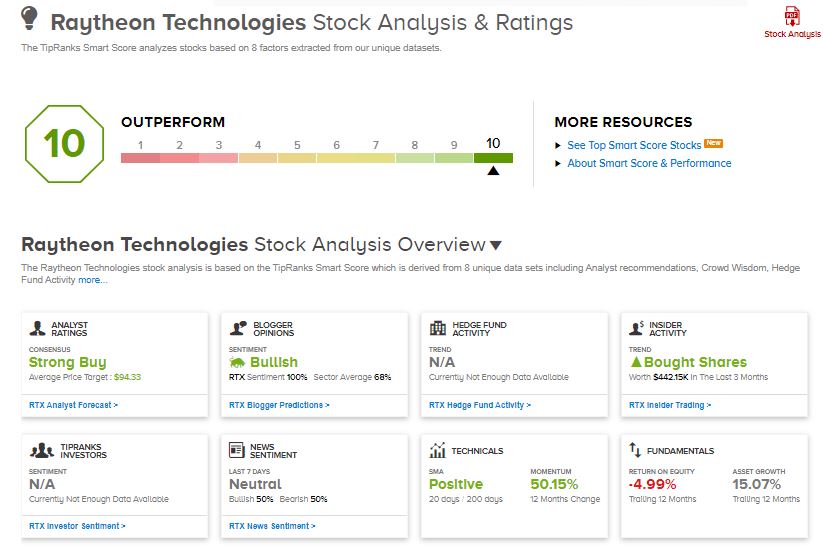

The partnership seeks to enable high-performance and affordable communication technologies. Plans are underway to develop the new semiconductor in Burlington, Vermont. (See Raytheon stock analysis on TipRanks)

“Raytheon Technologies was one of the pioneers advancing RF gallium arsenide technology which has been broadly used in mobile and wireless markets, and we have similarly been at the forefront of advancing gallium nitride technology for use in advanced military systems,” said Raytheon’s CTO Mark Russell.

GF’s partnership with Raytheon is one of many, as the company seeks to deliver differentiated solutions in the semiconductor industry. The company has invested $15 billion in semiconductor development over the last decade.

Raytheon’s delivery of an impressive 2025 sales target has caught the attention of Cowen & Co. analyst Cai von Rumohr.

Rumohr stated, “RTX’s Investor Day unveiled a 2025 sales/ops target that looks mostly plausible off the depressed 2020 base. It also showcased impressive technology (thermal materials, additive mfg. etc.) and a solid updated FCF/deployment guide. While it’s always hard to gauge five-year targets, the stock has a moderate 13.7x 2022 total enterprise value/EBITDA and scarcity value as the largest commercial aftermarket recovery play.”

The analyst has an $88 price target on the stock implying 3.90% upside potential to current levels.

Consensus among analysts on Wall Street is a Strong Buy based on 11 Buy and 2 Hold ratings. The average analyst price target of $94.33 implies 11.37% upside potential to current levels.

RTX scores a “Perfect 10” on TipRanks’ Smart Score rating system, suggesting it is likely to outperform the overall market.

Related News:

Triumph Deepens Business Ties with Boeing; Signs New Systems Contracts

IBM Acquires Waeg to Bolster Its Salesforce Business in Europe

Home Depot Delivers Strong Q1 Results, Net Earnings Nearly Double