QTS Realty Trust (QTS) has agreed to be taken over by Blackstone Group (BX) for $78 per share in an all-cash transaction worth $10 billion, including debt.

The offer price implies a 21% premium to QTS closing price of $64.49 on June 4 and a 24% premium to the weighted average share price over the last 3 months.

QTS Realty Trust is a provider of data center solutions, spanning more than 7 million square feet of owned mega scale data center space within North America and Europe. Following the announcement, shares of the company jumped 21.2% to close at $78.15 on June 7. (See QTS stock analysis on TipRanks)

As per the terms of the deal, QTS and its representatives can actively seek and consider alternative acquisition proposals till July 17. QTS has the right to terminate the deal with Blackstone, which is a global investment business, and enter into a more lucrative deal, subject to certain terms and conditions.

The board of both the companies unanimously approved the transaction.

QTS CEO Chad Williams said, “We see a significant market opportunity for growth as hyperscale customers and enterprises continue to leverage our world-class infrastructure to support their digital transformation initiatives. We are confident this transaction is the right step to achieve our strategic objectives in our next phase of growth.”

The acquisition is expected to close in the second half of 2021, subject to certain regulatory approvals.

Upon completion, QTS’ common stock will cease to list on the New York Stock Exchange. QTS will be jointly owned by Blackstone Infrastructure Partners and Blackstone Real Estate Income Trust.

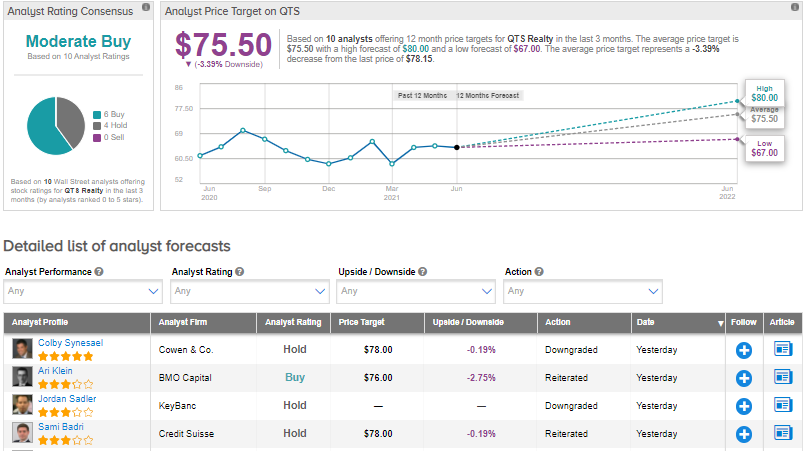

Following the acquisition announcement, Cowen & Co. analyst Colby Synesael downgraded QTS from Buy to Hold with a price target of $78 (0.2% downside potential).

Overall, the stock has a Moderate Buy consensus rating based on 6 Buys and 4 Holds. The QTS average analyst price target of $75.50 implies 3.4% downside potential from the current levels.

Related News:

Zumiez Posts Blowout Q1 Results; Shares Pop

ISS Recommends That Extended Stay America Shareholders Vote In Favor of Higher Deal Price

DTE Energy Announces Spin-Off Dividend of DT Midstream Shares