Plug Power Inc. (PLUG), the provider of turnkey hydrogen solutions for the global green hydrogen economy, has concluded the acquisition (announced this October) of Applied Cryo Technologies. The financial terms of the deal have been kept under wraps.

Applied Cryo Technologies is a provider of technology, equipment and services for the transportation, storage and distribution of liquefied hydrogen and other cryogenic gases. The acquisition is expected to help in the development of Plug Power’s green hydrogen infrastructure.

Benefits of the Acquisition

The acquired company enhances capabilities, expertise, and technologies of Plug Power, along with the addition of a liquid hydrogen delivery network and fleet, liquid hydrogen storage, and hydrogen mobility fueling. This, in turn, will enable the company to expand its green hydrogen ecosystem and reduce hydrogen infrastructure and logistics networks costs.

Not only this, more than 200 new employees will join Plug Power.

The acquisition depicts Plug Power’s target to create a complete green hydrogen ecosystem, from hydrogen production powered by renewables to storage and transportation, serving customers in North America and beyond, the company said in a release.

CEO Comments

The CEO of Plug Power, Andy Marsh, said, “This is a natural fit for Plug Power, and our new team members. We all share a vision to build and grow the green hydrogen economy. Applied Cryo Technologies’ leading cryogenic equipment design and manufacturing capabilities, combined with Plug Power’s green hydrogen production and distribution capabilities will help us realize our ambitious goal of producing over 1,000 tons per day of green hydrogen by 2028.” (See Plug Power stock charts on TipRanks)

Analysts Recommendation

On November 19, Morgan Stanley (MS) analyst Stephen Byrd maintained a Buy rating on the stock and raised the price target to $65 (53.8% upside potential) from $43.

Byrd commented, “We continue to believe PLUG is one of the best positioned companies in the hydrogen economy, given their strong balance sheet, scale, and vertical integration strategy, which we believe it can continue to achieve through future M&A.”

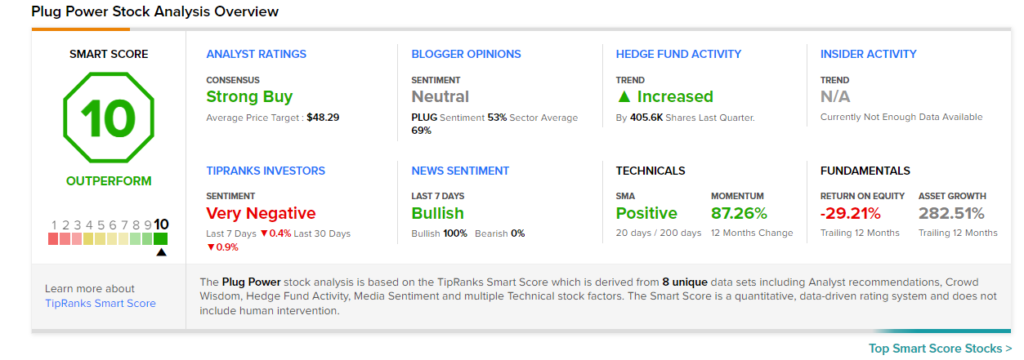

Consensus among analysts is a Strong Buy based on 13 Buys versus 4 Holds. The average Plug Power price target of $48.29 implies 14.24% upside potential from current levels. Shares have gained 58.2% over the past year.

Smart Score

Plug Power scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations. (See Top Smart Score Stocks on TipRanks)

Related News:

FDA Grants RMAT Designation to CRISPR’s CTX110

General Motors Acquires 25% Stake in Pure Watercraft; Shares Rise

Astra Enters Orbit; Shares Soar 17.2%