Struggling Californian energy company PG&E Corporation (PCG) has launched simultaneous underwritten public offerings of its common stock and its equity units, with the goal of raising $4 billion and $1.23 billion of gross proceeds, respectively.

The money raised will help the company fund its emergence from Chapter 11- which, if the offering is successful, could occur as soon as July 1.

PG&E also intends to grant the underwriters in each offering a 30-day option to purchase additional shares of common stock and equity units representing up to $400 million and $123 million of gross proceeds, respectively.

The offerings are currently expected to price this week with a closing date of July 1, subject to market conditions and customary closing conditions.

The common stock offering and equity units offering are separate public offerings and are not dependent on each other, PCG says. It has applied to list the equity units on the New York Stock Exchange under the symbol “PCGU.”

At the same time, as previously announced, up to $1.25 billion of the common stock offering has been reserved for investors who are beneficial owners of at least 1,000,000 shares of PG&E common stock on June 19, 2020.

Shares in San-Francisco based PCG and its utility subsidiary, Pacific Gas & Electric (PacGas), are currently trading down 8% year-to-date.

On June 16, PG&E Corp. pleaded guilty to 84 counts of manslaughter for the deadly 2018 Californian wildfire caused by faulty equipment. The company will now pay a maximum $3.5 million fine alongside $500,000 in investigation costs.

Subsequently, on June 20, U.S. Bankruptcy Judge Dennis Montali issued an order confirming PG&E’s Chapter 11 bankruptcy plan, which will see PG&E take on almost $40 billion in debt. The judge also authorized $13.5 billion in compensation for business and homeowners impacted by the wildfire.

“With its eminent exit out of bankruptcy, PG&E is set to rejoin the world of defensive utilities, albeit hobbled by lingering doubts as to whether the corner has been truly turned” writes RBC Capital analyst Shelby Tucker.

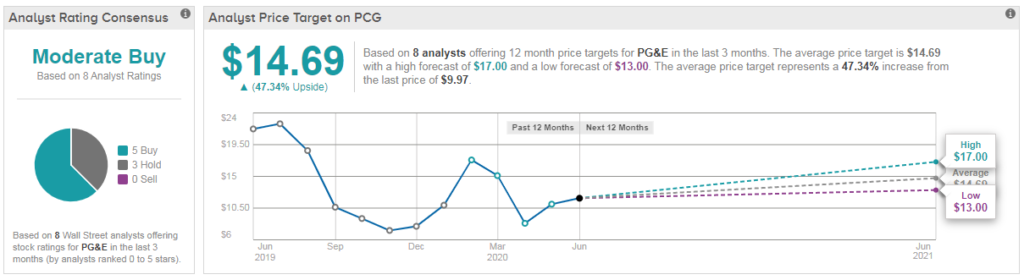

He has lowered his estimates to reflect the upcoming bankruptcy refinancing and reduced his PCG price target to $15 from $19. “Despite an attractive return, many questions remain prompting us to keep our Speculative Risk qualifier” the analyst told investors as he reiterated his Hold rating.

Overall, the stock has a cautiously optimistic Moderate Buy Street consensus with an average analyst price target of $15 (47% upside potential). (See PG&E Corporation stock analysis on TipRanks).

Related News:

PG&E Is Said To Ready $11 Billion Debt Financing Plan

PG&E Shares Sink 13% In Pre-Market On Discounted $3.25B Equity Sale

American Airlines To Upsize Share, Convertible Sale To $2B- Report