Pharmaceutical industry company Pfizer Inc. (PFE) announced that it has inked a strategic partnership deal with commercial-stage biopharmaceutical company Biohaven Pharmaceutical Holding (BHVN) for the commercialization of rimegepant outside the U.S. after obtaining regulatory approvals.

Rimegepant, which is designed for the acute treatment of migraine attacks with or without aura and the preventive treatment of episodic migraine in adults, is commercialized as Nurtec ODT, the first-of-its-kind oral CGRP (calcitonin gene-related peptide) receptor antagonist, in the U.S.

Notably, the application for the approval of rimegepant outside the U.S. is currently under the review of European Medicines Agency and several additional regulatory authorities.

Terms of the Agreement

As per the terms of the collaboration and license agreement, Pfizer will have the rights to commercialize rimegepant and zavegepant outside the U.S. While Biohaven will continue to lead research and development globally, Pfizer would commercialize outside the U.S.

Zavegepant is a third-generation, high affinity, selective and structurally unique, small molecule CGRP receptor antagonist, currently being studied in an intranasal delivery and a soft-gel formulation in Phase 3 clinical trials for migraine indications, the company said.

Further, Pfizer will pay an upfront amount of $500 million, which includes $150 million cash and an equity investment of $350 million in Biohaven at a 25% market premium. Additionally, Biohaven will receive up to $740 million in milestone payments and tiered double-digit royalties on net sales outside the U.S.

See Insiders’ Hot Stocks on TipRanks >>

Official Comments

The Global President at Pfizer Internal Medicine, Nick Lagunowich, said, “We believe our legacy in pain and Women’s Health combined with our experienced customer-facing colleagues, will enable us to maximize this opportunity with Biohaven, potentially bringing a valuable new treatment option to patients living with migraine pain.” (See Pfizer stock charts on TipRanks)

Analysts Recommendation

Recently, Mizuho Securities analyst Vamil Divan reiterated a Hold rating and a price target of $44 (7% downside potential) on the stock.

Divan believes that the recent “impressive interim oral anti-viral data will add another leg to Pfizer’s near-term growth.”

Overall, the stock has a Hold consensus rating based on 9 Holds versus 2 Buys. The average Pfizer price target of $45.80 implies 3.17% downside potential from current levels. Shares have increased 29.1% over the past year.

Risk Analysis

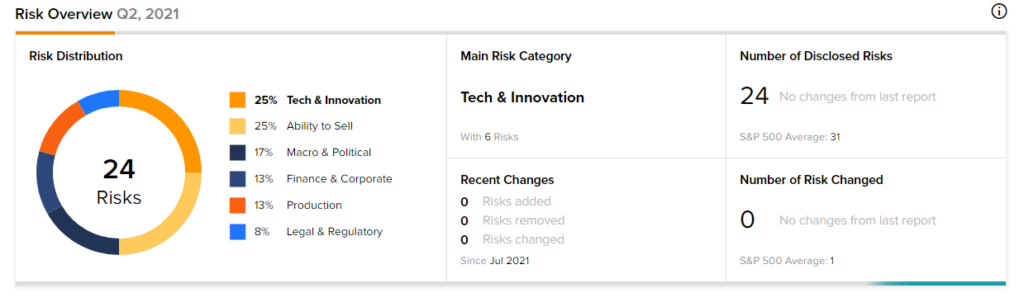

According to the new TipRanks’ Risk Factors tool, the Pfizer stock is at risk mainly from three factors: Tech and Innovation, Ability to Sell and Macro & Political, which contribute 25%, 25%, and 17%, respectively, to the total 24 risks identified for the stock.

Related News:

Roblox Jumps 28% on Lower-than-Feared Q3 Loss, Bookings Rise

AMC Entertainment Books Lower-than-Expected Q3 Loss

Aterian Posts Strong Q3 Revenues; Shares Gain 23.6%