PepsiCo, Inc. (PEP) reported better-than-expected fiscal third-quarter results on the back of top-line growth and cautiously navigating through the volatile supply chain and cost environment.

The global food and beverage company recorded adjusted earnings of $1.79 per share in the third quarter, beating the Street’s estimate of $1.73 per share. The company reported earnings of $1.66 per share in the same quarter last year.

Additionally, adjusted net revenues generated in the quarter amounted to $20.19 billion, topping analysts’ expectations of $19.39 billion. Revenues surged 9% year-over-year. According to the company, investments made towards becoming a faster, stronger and better company remained favorable during the quarter.

Expressing confidence about the results, PepsiCo CEO Ramon Laguarta said, “Given our year-to-date performance, we now expect our full-year organic revenue to increase approximately 8 percent and core constant currency earnings per share to increase at least 11 percent.” (See PepsiCo stock charts on TipRanks)

For Fiscal 2021, the company expects minimum adjusted EPS of $6.20, compared to the consensus estimate of $6.24.

Looking ahead, PepsiCo CFO Hugh Johnston said, “I do expect there will probably be some price increases in the first quarter of next year as well, as we fully absorb and lock down the impact of commodity inflation.”

Furthermore, Johnston expects that supply-chain disruptions will moderate mostly by the end of 2021.

On September 27, Deutsche Bank analyst Stephen Powers maintained a Hold rating on the stock but raised the price target to $158 (4.6% upside potential) from $154 ahead of the company’s fiscal third quarter results.

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 7 Buys and 6 Holds. The average PepsiCo price target of $166.08 implies 9.92% downside potential to current levels. Shares have increased 11.3% over the past year.

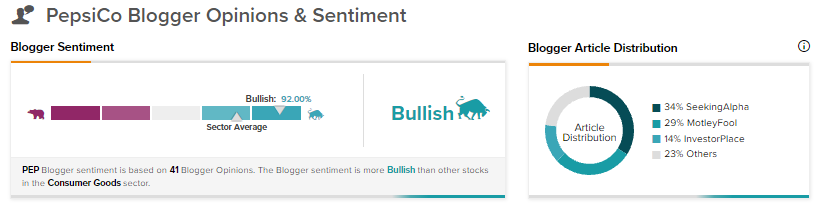

TipRanks data shows that financial blogger opinions are 92% Bullish on PEP, compared to a sector average of 74%.

Related News:

Dynavax Partners with DOD to Develop Adjuvanted Plague Vaccine

Accuray Inks Deal with C-RAD to Enhance Breast Cancer Treatment

Xencor Inks Collaboration and License Agreement with Janssen; Shares Rise