Shares of human capital management solutions provider Paychex, Inc. (NASDAQ:PAYX) gained 5.5% on Wednesday to close at $133.41 after the company reported strong financial results for the fiscal second quarter ended November 30.

The stock went up another 0.3% in the extended trading session.

New York-based Paychex offers human resource, payroll, retirement, and insurance services for small- to medium-sized businesses. It has more than 100 offices serving approximately 670,000 clients in the U.S. and Europe.

Earnings came in at 0.91 per share, up 25% year-over-year, and beat the Street’s estimate of $0.80 per share.

Total revenue grew 13% to $1.11 billion, surpassing analysts’ expectations of $1.06 billion.

Martin Mucci, Chairman and CEO of Paychex, said, “Results were driven by growth in employees within our client base and continued strong sales growth and client retention.”

Management Solutions revenue increased 14% year-over-year to $832 million, and Professional Employer Organization (PEO) and Insurance Solutions revenue climbed 11% to $262.4 million.

Further, operating income rose 24% to $440.3 million.

FY2022 Guidance

The company has updated its guidance for Fiscal 2022 ending May 31, 2022, to incorporate the impact of current market conditions.

Paychex expects adjusted EPS to grow in the range of 18% to 20%, compared to the consensus EPS estimate of $3.46.

Total revenue growth is anticipated to range from 10% to 11%, against the Street’s revenue expectation of $4.4 billion.

Moreover, revenues for the Management Solutions and PEO and Insurance Solutions segments are expected to rise in the range of 10% to 11% and 10% to 12%, respectively.

Wall Street’s Take

After the release of the results, Stifel Nicolaus analyst David Grossman maintained a Hold rating on the stock and raised the price target to $140 from $118 (5% upside potential).

The analyst said, “The macro backdrop makes us more positive near-term; however, we are watching for evidence of more sustainable fundamental change (competitive gains) to get more constructive longer-term.”

Additionally, Cowen & Co. (COWN) analyst Bryan Bergin reiterated a Hold rating with a $120 price target (10.1% downside potential).

Overall, the stock has a Hold consensus rating based on 10 Holds and 1 Sell. The average Paychex stock price prediction of $120.73 implies a 9.5% downside potential. Shares have gained 47.6% year-to-date.

Risk Analysis

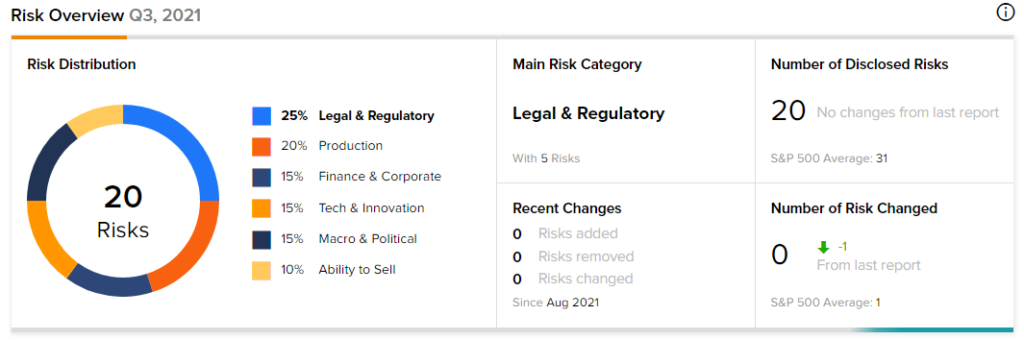

According to TipRanks’ Risk Factors tool, Paychex is at risk mainly from two factors: Legal & Regulatory and Production, which account for 25% and 20%, respectively, of the total 20 risks identified for the stock.

Related News:

AMC to Reopen Theatres in Chicago & Los Angeles

CarMax Plunges 6.7% Despite Robust Q3 Results

Dye & Durham to Buy Link Group; Shares Pop