Shares of Palantir Technologies (PLTR) jumped 9.4% on May 11 after the company beat revenue estimates in the first quarter.

The software company’s total revenues of $341 million surpassed the Street’s estimates of $332.23 million and grew 49% from the year-ago period.

On an adjusted basis, Palantir earned $0.04 per diluted share for its most recent quarter, compared to an adjusted loss of $0.01 per diluted share in the prior-year period. Adjusted profit was in line with analysts’ expectations of $0.04.

U.S. commercial and U.S. government revenues grew 72% and 83% year-over-year, respectively. (See Palantir Technologies stock analysis on TipRanks)

For Q2, the company projects revenue to be $360 million, indicating revenue growth of 43% on a year-over-year basis. The consensus estimate for the second quarter is pegged at $344.31 million.

Additionally, the company continues to expect revenue growth of 30% or even greater on an annual basis for 2021 through 2025.

Following the Q2 earnings release, Goldman Sachs analyst Christopher D. Merwin decreased the stock’s price target to $30 from $34 for a 48.4% upside potential and reiterated a Buy rating on Palantir.

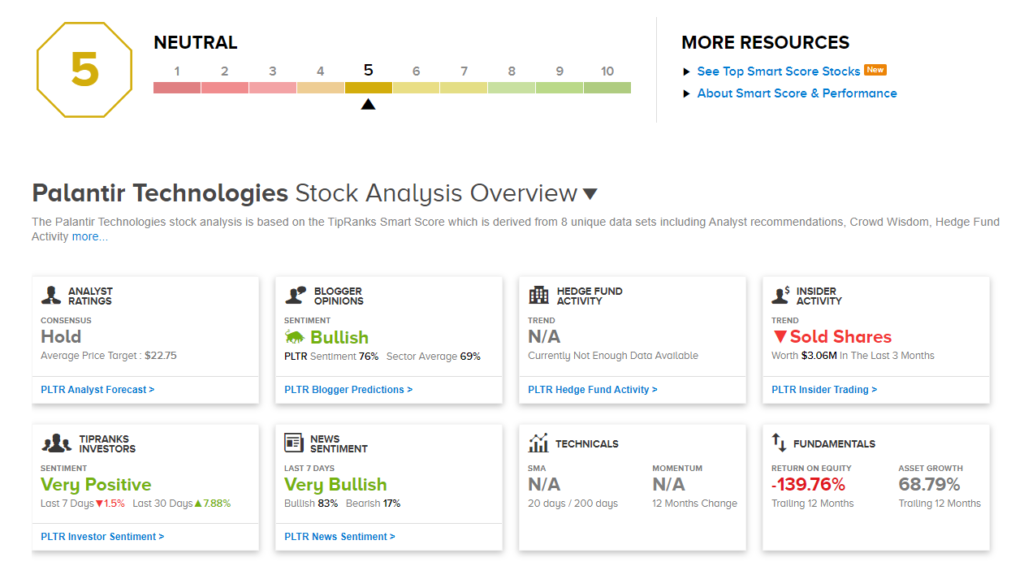

Overall, the stock has a Hold consensus rating based on 2 Buys, 3 Holds, and 4 Sells. The average analyst price target of $22.75 implies 9.5% upside potential from current levels. Shares have increased 38.6% over the past six months.

Furthermore, according to TipRanks’ Smart Score system, Palantir gets a 5 out of 10, which indicates that the stock is likely to perform in line with market averages.

Related News :

EPAM Snaps Up Just-BI; Street Says Buy

Facebook Facing Fine Over Unconsented Israeli Acquisitions?

Buoyed By Demand, ADM to Build Soybean Crushing Plant In North Dakota