Omnicom Group, Inc. (OMC) announced that its media services division Omnicom Media Group (OMG) has acquired New York-based, Jump 450 Media, a performance marketing agency. Shares closed at $75.24 on October 6.

Omnicom Group is a global media, marketing, and corporate communications holding company. With a market cap of $16.13 billion, shares have gained 44.3% over the past year. (See Omnicom Group stock charts on TipRanks)

Founded less than a decade ago, Jump 450 Media has created a name for itself as one of the best places to work and has won several awards over the years. The company aims to provide best in class performance marketing services and focuses on customer acquisition for high-growth and enterprise clients in industries like consumer, health and wellness, gaming, and fintech. Furthermore, the company utilizes algorithmic scaling strategies, rapid creative testing, and robust data analytics to optimize its clients’ digital media spend.

Commenting on the deal, Daryl Simm, Global Chairman and CEO of OMC, said, “Jump’s focus on pure performance marketing and e-commerce media will add a distinct set of capabilities to OMG’s existing performance media offerings…Their performance and transformation expertise will amplify impact for high-growth and outcomes-focused clients. We are thrilled to welcome such an entrepreneurial team of leaders and talented professionals.”

Recently, J.P. Morgan analyst Alexia Quadrani lifted the price target on the stock to $93 (23.6% upside potential) from $90 while maintaining a Buy rating.

OMC is scheduled to report its Q3FY21 earnings on October 19, before which Quadrani has raised the company’s organic growth estimates. Based on the Channel checks and read-throughs from media peers, the analyst noted that the advertising market is witnessing strong growth that will benefit the industry due to significant lifestyle and work changes by consumers. She goes on to state that the Delta variant will not have any material impact on advertising demand.

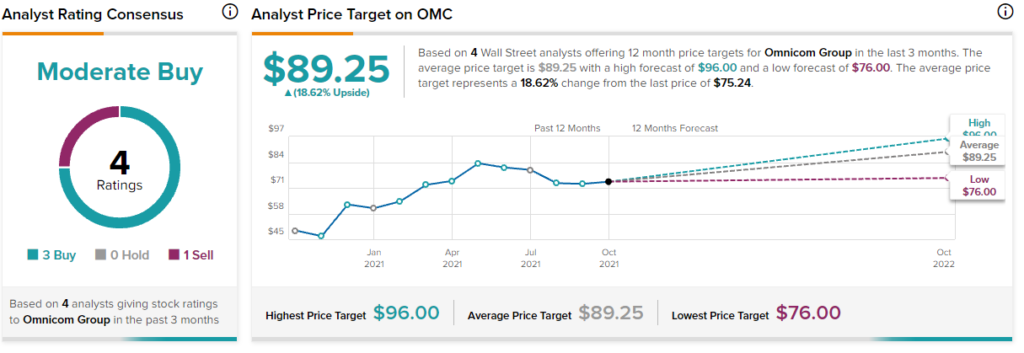

Overall, the stock has a Moderate Buy consensus rating based on 3 Buys and 1 Sell. The average Omnicom Group price target of $89.25 implies 18.6% upside potential to current levels.

Related News:

Tesla Hikes Prices of Model 3 and Model Y

Levi’s Beats Q3 Expectations; Shares Pop After-Hours

Why is Intuitive Surgical Trending?