Nucor Corporation (NUE), a manufacturer of steel and steel products, has inked a deal to acquire a majority ownership stake in California Steel Industries, Inc. (CSI). Following the news, shares of the company gained 2.1% to close at $15.55 on Monday.

CSI, a flat-rolled steel converter, can produce more than two million tons of finished steel and steel products annually. The company works with five product lines, including hot-rolled, pickled and oiled, cold-rolled, galvanized, and ERW pipe. CSI provides its products to the construction, service center, and energy industries.

Agreements

Per the terms of agreements, Nucor will purchase a 50% equity interest from a subsidiary of Vale S.A. and a 1% equity ownership stake from JFE Steel Corporation. Pending the required regulatory approvals, the company will be a joint venture between Nucor and JFE.

Nucor will pay $400 million in cash to Vale for the 50% enterprise value, including adjustments for net debt and working capital, which equates to less than 6.0x historical average EBITDA. (See Nucor stock charts on TipRanks)

Upon the closing of the acquisition, the company will be Nucor’s second joint venture with JFE. Since 2020, the two companies have been running an automotive steel joint venture in Mexico, which has the capacity to produce 400,000 tons of galvanized steel for the automotive industry per year.

See Top Smart Score Stocks on TipRanks >>

CEO Comments

The CEO of Nucor, Leon Topalian, said, “Acquiring a majority ownership stake in California Steel Industries expands our geographic reach in sheet steel and gives us a strong presence on the West Coast.”

“This acquisition will grow our portfolio of value-added sheet products, provide opportunities for increased internal shipments and enable us to provide our downstream businesses in the region such as Verco and Hannibal Industries with sheet steel products. We look forward to continuing to grow with our partners at JFE,” Topalian added.

Analysts Recommendation

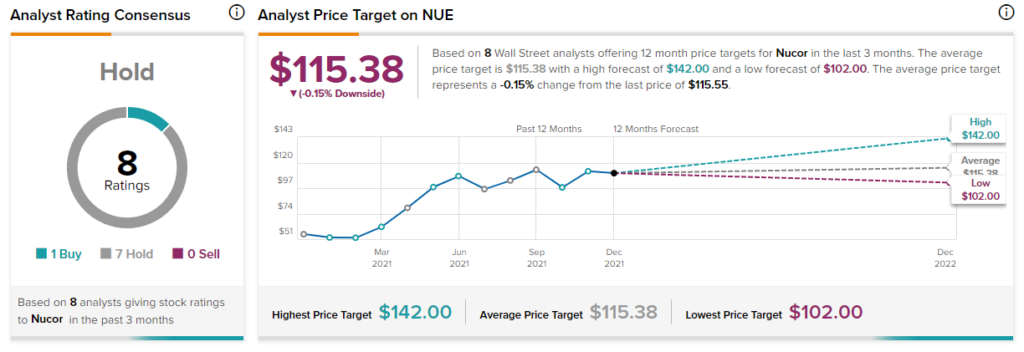

On December 10, J.P. Morgan analyst Michael Glick maintained a Hold rating on the stock and decreased the price target to $102 (11.73% downside potential) from $118.

Overall, the stock has a Hold consensus rating based on 7 Holds versus 1 Buy. The average Nucor price target of $115.38 implies that shares are fully valued at current levels. Shares have gained 12.5% over the past six months.

Related News:

Phillips 66 Unveils 2022 Capital Plan Worth $1.9B

T. Rowe Price’s AUM Decline in November; Shares Fall

Pfizer Receives EC Approval for Cibinqo