McDonald’s, the world’s leading global food service retailer, reported fourth quarter and year end 2020 revenues and earnings on Thursday that missed analysts’ estimates.

McDonald’s (MCD) Q4 earnings came in at $1.70 compared to analysts’ expectations of $1.80, which represents a year-on-year decrease of 14%. Fourth quarter and full year revenues of $5.31 billion and $19.2 billion, respectively, also fell short of analysts’ forecasts.

McDonald’s President and Chief Executive Officer, Chris Kempczinski, said, “2020 will be remembered as one of McDonald’s most challenging, yet inspiring, moments in our long history. The resilience of the McDonald’s System was on display – making safety and service a priority, putting our customers and people first, and running great restaurants…we’re confident we can continue to capture market share and drive long-term sustainable growth for all stakeholders.”

McDonald’s noted that the resurgence of COVID-19 and government restrictions continue to limit dine-in capacity in most countries and expects disruptions in operations for as long as these conditions persist. (See MCD stock analysis on TipRanks)

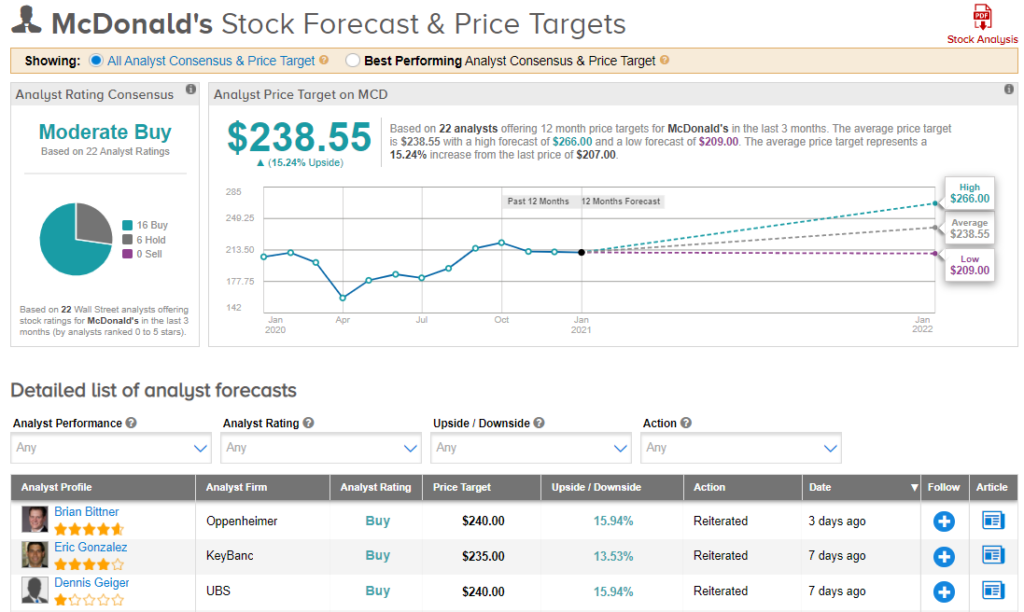

Keybanc analyst Eric Gonzalez reiterated his Buy rating on MCD last week and set his price target at $235. This implies upside potential of around 14% from current levels.

Gonzalez noted the challenges caused by the coronavirus pandemic but feels that McDonald’s “remains well-positioned as the category leader in the majority of its international markets, where it entered the pandemic with a strong track record of same-store sales growth.”

Consensus among analysts is a Moderate Buy based on 16 Buys and 6 Holds. The average price target of $238.55 suggests upside potential of around 15% over the next 12 months.

Related News:

Tesla Sinks 8% Pre-Market After 4Q Profit Miss; Street Sees 25% Downside Risk

Levi Strauss Sinks 9% Pre-Market As 1Q Guidance Disappoints

GameStop Surges Another 135% Amid Epic Short Squeeze