Kohl’s (KSS) said it has seen a surge in online sales in the first quarter, while the department store chain posted larger losses than the market expected due to store closures during the coronavirus pandemic.

Online sales in the first quarter ended May 2 increased 24% and accelerated to more than 60% in April. Net sales in the reported quarter plunged 44% to $2.16 billion. The department store chain reported adjusted loss per share of $3.20, missing market expectations of a $1.80 loss.

“We entered the year in a strong financial position and our business was tracking to our expectations prior to the onset of the crisis,” said Michelle Gass, Kohl’s CEO. “Our actions to manage cash outflow and increase liquidity have been instrumental in enhancing our position to navigate this crisis, and we believe our history of prudent capital management will continue to serve us well.”

Shares in Kohl’s have nosedived some 62% so far this year as the department store chain was forced to shut its stores down on March 20 to help contain the fast spread of the coronavirus pandemic.

“We have begun the rebuilding process, recently reopening about 50% of our stores across the country. In doing so, we have taken special care to equip our stores with the latest health and safety measures,” said Gass. “As we look ahead, we know this experience will have a lasting impact to customer behavior and the retail landscape, and we are evolving our strategies to ensure our relevance and to capture market share.”

Investors initially welcomed Kohl’s online sales growth figures and the management’s update on store reopenings as the stock rose as much as 4.5% in pre-market U.S. trading. Following the opening of U.S. financial markets, the shares swung into declines dropping 8.8% to $17.16 in morning trading.

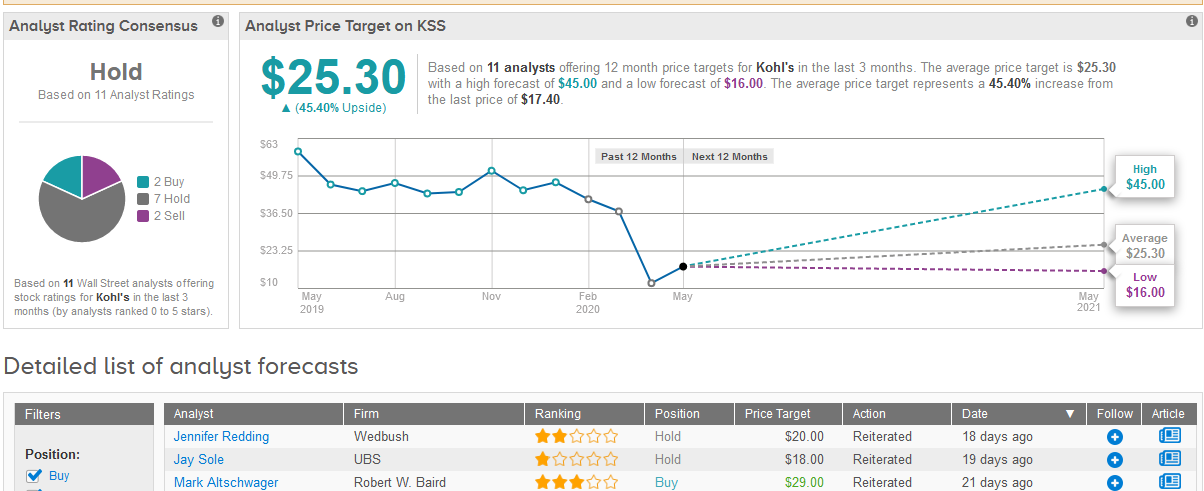

Overall, Wall Street analysts are sidelined on Kohl’s stock. Out of the 11 analysts, 7 have Holds, 2 have Sells, and 2 have Buys adding up to a Hold consensus. The $25.30 average price target indicates 45% upside potential in the shares in the coming 12 months. (See Kohl’s stock analysis on TipRanks).

Kohl’s reported that it ended the quarter with $2 billion in cash. In addition, the chain operator “significantly” reduced expenses across the business inclusive of marketing, technology, operations and payroll, and cut capital expenditures by about $500 million. In an effort to preserve its cash coffers, it suspended its share repurchase program and withdrew its regular quarterly cash dividend beginning in the second quarter of 2020.

Related News:

GM Director Displays Confidence in Company Despite Recent Troubles

Baidu Pops 8% After-Hours After Strong Earnings Beat

President Trump Takes Aim at Digital Tech Giants From Google to Twitter