Keysight Technologies (KEYS) acquires quantum computing software Quantum Benchmark for an undisclosed amount. Keysight manufactures electronics test and measurement equipment and software.

Quantum Benchmark offers software solutions that help to identify and overcome the error challenges required for high-impact quantum computing. These solutions improve and validate quantum computing hardware capabilities.

The acquisition of Quantum Benchmark is in line with Keysight’s aim to expand its quantum portfolio in a bid to meet increasing customer needs across the physical, protocol, and application layers.

The latest deal is the company’s third acquisition in the quantum space. The first occurred in August 2016 with the acquisition of Signadyne, while the second deal was completed in March 2020 with the acquisition of Labber Quantum.

Keysight’s Commercial Communications president Kailash Narayanan said, “As the quantum ecosystem continues to form, Keysight is committed to providing customers with a full suite of solutions for the overall quantum stack. We are pleased to announce the addition of Quantum Benchmark to our portfolio, providing unique capabilities for solving complex qubit error and validation challenges.”

He added, “The talented Quantum Benchmark team will be a valuable addition to Keysight and will further our mission to accelerate innovation to connect and secure the world.” (See Keysight Technologies stock analysis on TipRanks)

On May 19, Keysight reported strong fiscal Q2 results. The company’s total revenues of $1.22 billion surpassed the Street’s estimates of $1.21 billion and jumped 36% from the year-ago period. Also, earnings soared 84.6% to $1.44 per share, beating the consensus estimates of $1.34 per share.

Following the fiscal Q2 earnings, Susquehanna analyst Mehdi Hosseini maintained a Buy rating and a price target of $178 (27.2% upside potential).

Hosseini said, “We were concerned that weak 5G BTS demand would adversely weigh on KEYS’ orders/guide. However, the company’s diverse product portfolio and customer mix once again proved that KEYS can ride out the volatility in one particular end-market segment.”

Consensus among analysts is a Strong Buy based on 3 Buys versus 1 Hold. The average analyst price target stands at $163.25 and implies upside potential of 16.6% to current levels. Shares have gained almost 35.4% over the past year.

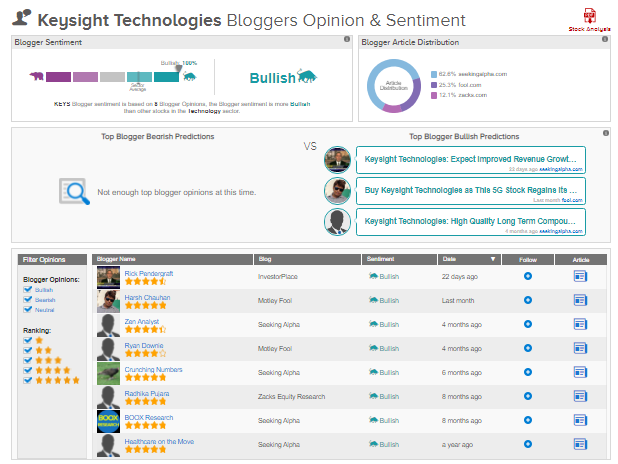

TipRanks data shows that financial blogger opinions are 100% Bullish on Keysight Technologies, compared to a sector average of 69%.

Related News:

Beam Global Posts Smaller-Than-Feared Quarterly Loss; Revenue Misses Estimates

Builders Firstsource to Snap Up Cornerstone Building for $400M, Boost Geographic Presence

Target Hospitality Posts Loss in Q1; Shares Up