Extended Stay America, Inc. (STAY), together with its paired-share REIT, ESH Hospitality, revealed that leading independent proxy advisory firm Institutional Shareholder Services Inc. (ISS) has reversed its prior voting recommendation.

In March, STAY agreed to be taken private in a 50/50 joint venture between Blackstone Real Estate Partners (BX) and private investment firm Starwood Capital Group. The deal was priced at $19.50 per share for a total cash consideration of $6 billion.

The offer price faced criticism from investors, especially, Tarsadia Capital which owned a 3.9% stake in Extended Stay. The investor believed that that the offer price undervalued the company and expected a higher price for the shares.

According to the new amendments, Blackstone and Starwood Capital will now pay STAY shareholders an additional $1.00 per paired share for a total cash consideration of $20.50. The deal is subject to a shareholder vote.

The boards of directors of both companies unanimously approved the recent amendments to the deal. (See STAY stock analysis on TipRanks)

STAY’s Chairman Doug Geoga said, “The ISS recommendation is consistent with our firm belief that this transaction is the right outcome for shareholders and provides superior value to our continued operation as a public company.”

He further added, “In addition to the unanimous support of our Boards, we are also pleased to note that the transaction is now supported by a number of our large shareholders who had previously expressed concerns.”

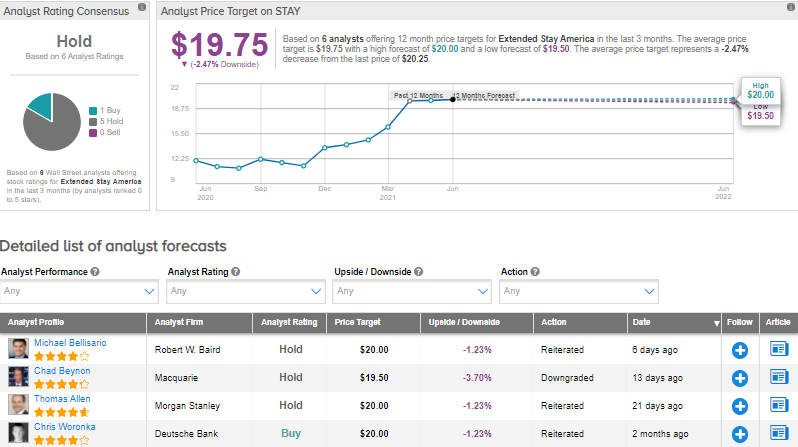

On May 17, Morgan Stanley analyst Thomas Allen maintained a Hold rating on STAY but increased his price target from $16 to $20. This implies that the stock is fully priced at current price levels.

Overall, the stock has a Hold consensus rating based on 1 Buy and 5 Holds. The average analyst price target of $19.75 implies 2.5% downside potential from current levels.

Related News:

Lululemon Athletica Posts Upbeat Q1 Results, Raises FY21 Guidance

National Health Investors Cuts Dividend by 18.4%

United Airlines Inks Deal to Buy Aircraft from Boom Supersonic