Invesco announced that its preliminary assets under management (AUM) during the month ended Feb. 28 rose 1.8% to $1.39 trillion from the prior month, mainly driven by favorable market returns, which increased AUM by $13 billion, and positive inflows.

Invesco (IVZ) recorded total net inflows of $11.2 billion, with foreign exchange movements growing AUM by $0.4 billion. Shares of the Hamilton-based investment manager increased 1.7% to close at $24.48 on March 9.

The company’s equity AUM advanced 2.5% to $706.9 billion versus the prior month. Money market AUM gained 2.8% to $117.5 billion. Alternatives AUM grew marginally to $179.6 billion, while fixed income AUM remained almost stable. (See Invesco stock analysis)

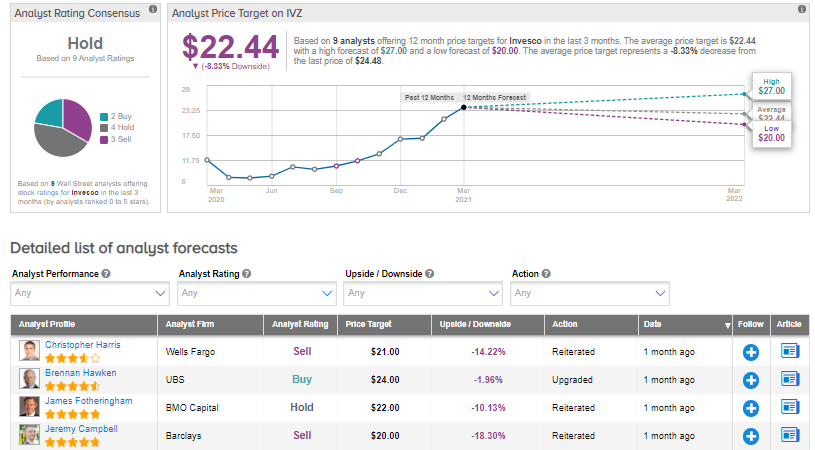

On Jan. 28, UBS analyst Brennan Hawken upgraded the stock to Buy from Neutral and increased the price target to $24 (2% downside potential) from $18.

The analyst noted, “Expectations have become too pessimistic with forecasts calling for marginal inflows and fee rate pressure to continue.”

“The growth opportunity with institutional clients will put less pressure on the firm-wide fee rate than several years ago,” Hawken added.

The rest of the Street is sidelined on the stock with a Hold consensus rating based on 2 Buys, 4 Holds, and 3 Sells. The average analyst price target of $22.44 implies 8.3% downside potential to current levels. Shares have appreciated 44.4% so far this year.

Related News:

AeroVironment’s Quarterly Results Beat Street Estimates As Sales Pick Up

Toll Brothers Bumps Up Quarterly Dividend By 54%; Street Says Hold

Castle Biosciences Sinks 6% On Wider-Than-Expected 4Q Loss, Sales Top Estimates