Intuit Inc. (INTU) delivered outstanding first-quarter results. Shares of the American financial software provider were up 9.1% during the extended trading session on November 18 and closed at $628.94.

With earnings and revenue both registering double-digit growth and outpacing estimates, the company increased its full-year fiscal 2022 outlook.

Robust Results

Intuit reported earnings of $1.53 per share, up 63% year-over-year, and 54 cents higher than analysts’ estimates of $0.99 per share.

Furthermore, total revenue rose 51.5% year-over-year to $2 billion, surpassing analysts’ estimates of $1.81 billion.

Driven by customer additions, favorable pricing, and mix shift, Intuit’s Small Business and Self-Employed group revenue jumped 22%, and QuickBooks Online Accounting revenue grew 32% against the same quarter last year.

Moreover, Credit Karma witnessed solid revenue growth aided by demand in both personal loans and credit cards.

Management Comments

Intuit CEO, Sasan Goodarzi, said, “We are off to a strong start in fiscal year 2022, delivering on our strategy of becoming an AI-driven expert platform powering the prosperity of consumers and small businesses… We continue to see strong momentum and proof that our Big Bets are further positioning us for durable growth in the future, and we’re delighted that Mailchimp has joined Intuit.”

See Analysts’ Top Stocks on TipRanks >>

Updated Guidance

Intuit increased its full-year fiscal 2022 guidance based on a strong start to the fiscal year coupled with the Mailchimp acquisition completed on November 1. Excluding the Mailchimp acquisition, the company lifted its full-year guidance to reflect strong business momentum.

In Q2, Intuit expects revenue to be between $2.719 billion and $2.749 billion, and earnings are expected to be between $1.84 per share and $1.88 per share.

For FY22, Intuit forecasts revenue to fall in the range of $12.165 billion to $12.3 billion against the consensus estimate of $11.16 billion.

Additionally, full-year earnings are now expected to be in the range of $11.48 per share to $11.64 per share against the consensus estimate of $11.23 per share.

Capital Allocation

During the quarter, Intuit undertook a $4.7 billion term loan to partially fund the Mailchimp acquisition. The company also repurchased $339 million of common shares with $3 billion remaining under its authorized share repurchase program. The Board approved a $0.68 per common share to be paid on January 18, 2022.

Target Price

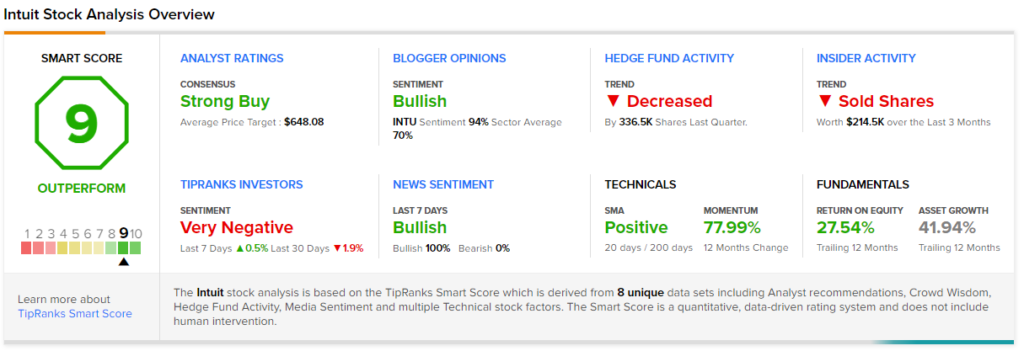

The Wall Street community has a Strong Buy consensus rating on the INTU stock with 15 Buys and 1 Hold. The average Intuit price target of $648.08 implies 3% upside potential to current levels. Shares have gained 74% over the past year.

Smart Score

Intuit scores a 9 out of 10 on the TipRanks’ Smart Score rating system, which indicates that the stock has strong potential to outperform market expectations.

Related News:

TJX Delivers Robust Q3 Results; Shares Hit All-Time High

Shoe Carnival Q3 Results Outperform; Shares Hit All-Time High

Victoria’s Secret Beats Q3 Earnings; Shares Up