Inovio Pharmaceuticals (INO) surged almost 10% after the company said that preclinical study data results of its potential vaccine candidate showed “robust” neutralizing antibody and T cell immune responses against coronavirus.

Shares rose 9.5% to $15.94 in midday U.S. trading. The value of the stock has this year gone up five-fold with investors excited about Inovio’s potential Covid-19 vaccine INO-4800. The vaccine drug candidate targets the major antigen Spike protein of SARS-CoV-2 virus, which causes Covid-19 disease.

“These positive preclinical results from our Covid-19 DNA vaccine not only highlight the potency of our DNA medicines platform, but also build on our previously reported positive Phase 1/2a data from our vaccine against the coronavirus that causes MERS, which demonstrated near-100% seroconversion and neutralization from a similarly designed vaccine INO-4700,” said Kate Broderick, Inovio’s Senior VP of R&D. “The potent neutralizing antibody and T cell immune responses generated in multiple animal models are supportive of our currently on-going INO-4800 clinical trials.”

The study found that vaccination with INO-4800 generated robust binding and neutralizing antibody as well as T cell responses in mice and guinea pigs. What’s more Inovio now expects in June to receive preliminary safety and immune responses data from Phase 1 clinical trial.

“We are planning to utilize these positive preclinical results along with our upcoming animal challenge data and safety and immune responses data from our Phase 1 studies to support rapidly advancing this summer to a large, randomized Phase 2/3 clinical trial,” said Dr. J. Joseph Kim, Inovio’s President & CEO.

Inovio is currently preparing to initiate a larger Phase 2 vaccine trial for INO-4700 in the Middle East where most MERS viral outbreaks have occurred. Phase 2/3 trial is now planned to start in July or August pending regulatory approval.

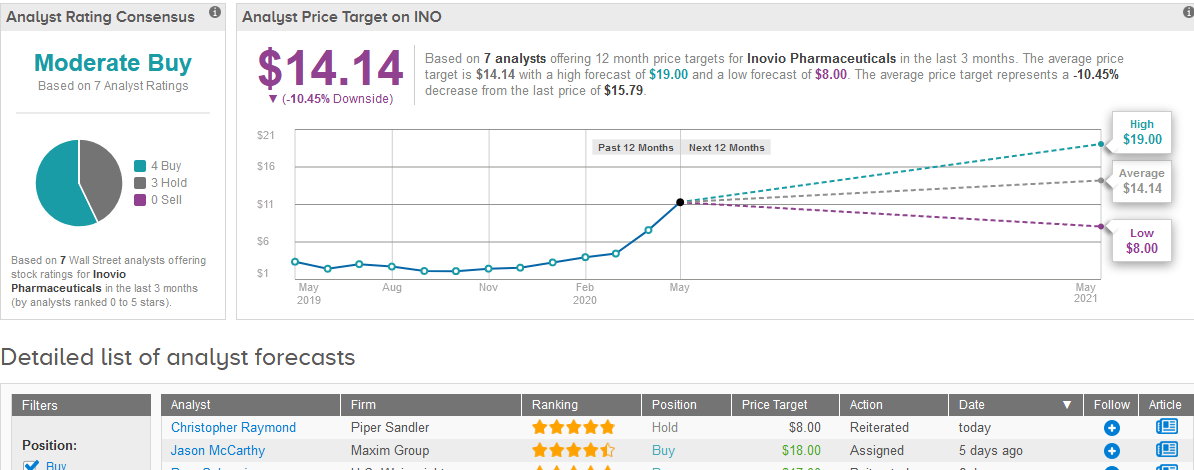

Five-star analyst Jason McCarthy at Maxim Group this month raised his price target on the stock to $18 from $12 and maintained a Buy rating.

“Inovio and its deep pipeline of DNA vaccines for infectious diseases, including other coronaviruses, has demonstrated safety and induced robust immune responses, more than any in the space, in our view,” McCarthy wrote in a note to investors. “Yet, from a valuation perspective INO lags its nucleic-acid vaccine peers MRNA and BNTX.

The Street has a cautiously optimistic outlook on Inovio, with a Moderate Buy consensus based on 4 Buys and 3 Holds. As share prices have skyrocketed so quickly, the $14.14 average analyst price target now indicates more than 10% downside potential. (See Inovio stock analysis on TipRanks).

Related News:

Bluebird Prices New Shares At $55, Seeks To Raise $500 Million

Moderna Spikes 21% Amid “Positive” Early-Stage Covid-19 Vaccine Data

AstraZeneca-Merck Lynparza Prostate Cancer Treatment Gets FDA Approval