The price of Sykes Enterprises (SYKE) shares was up 29.8% to close at $53.45 on June 18. Sykes Enterprises is a provider of business process outsourcing services, IT consulting, and IT-enabled services, such as technical support and customer service.

Currently, the company has a $2.13 billion market capitalization. SYKE has gained 99.5% in the past year and 40.7% over the past six months.

On Friday, Sykes Enterprises agreed to be acquired by Sitel Group at $54 per share. The announcement of the deal is expected to have boosted the SYKE stock price.

More Details about the Acquisition

The buyout is an all-cash transaction valued at approximately $2.2 billion. The purchase price represents a premium of 31.2% over Sykes Enterprises’ closing price on June 17.

The deal, which is not subjected to any financing condition, is expected to be completed in the second half of 2021. However, it awaits certain approvals and customary closing conditions. Upon closure of the deal, SYKES will become a privately-held company and its shares will no longer trade on Nasdaq.

The combined company is expected to become a better player in the business process outsourcing market, with a larger range of customer experience products and solutions.

Sykes Enterprises CEO Chuck Sykes said, “This combination marks a major milestone in our more than 40-year operating history. Thanks to the hard work of our team members, this transaction validates the execution of our vision, strategy, our differentiated full lifecycle business model and promises immediate and certain value for our stockholders at an attractive premium.” (See Sykes stock chart on TipRanks)

Apart from the announcement, the company has boasted strong earnings results.

Earnings Details

On May 4, Sykes Enterprises reported impressive fiscal first quarter numbers. Sykes’ results were driven by record sales and a rise in the number of new clients.

The company posted Q1 adjusted earnings of $0.73 per share, up 65.9% from the year-ago quarter and also outpaced the Street estimates of $0.69.

Revenues jumped 11.4% year-over-year to $457.9 million and surpassed analysts’ expectations of $457.4 million. Comparable revenue growth was 11.4% during the quarter.

Also, the company provided strong fiscal 2021 projections. For fiscal 2021, the company projects revised adjusted EPS to be in the range of $3.02 to $3.12 per share versus the consensus estimate of $3.03. Revenue is expected to land between $1.843 billion and $1.858 billion. The consensus estimate is pegged at $1.85 billion.

Analysts’ Opinions

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 2 Buys and 1 Hold. The average analyst Sykes Enterprise price target of $53.00 implies that shares are fully valued at current levels

Following the merger announcement with Sitel Group, Sidoti analyst Josh Vogel downgraded the rating to Hold from Buy, while maintaining a price target of $54 on the stock.

On May 6, Barrington analyst Vincent Colicchio maintained a Buy rating on the stock and increased the price target to $50.00 from $48.00. This implies 6.5% downside potential to current levels.

Colicchio commented, “The company’s 2021 financial guidance reflects healthy demand from existing and new clients. Demand should be broad based across several verticals. The communications and travel/leisure verticals, which declined in Q1/21 should start growing again in Q3/21 and Q4/21.”

TipRanks Vital Metrics

Sykes Enterprises scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

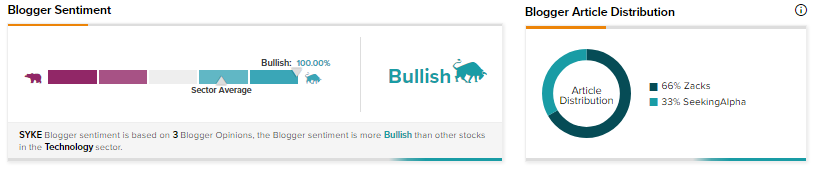

TipRanks data shows that financial blogger opinions are 100% Bullish on SYKE, compared to a sector average of 69%.

Related News :

Commercial Metals Posts Better-than-Expected Q3 Results

Jabil Q3 Results Beat Analysts’ Expectations; Shares Up 2%

Advanced Micro Devices Stock Popped 6%; Will the Momentum Continue?