Hexo Corp. (HEXO) to snap up Redecan, a privately held Canadian cannabis company, for $925 million in a cash and stock deal. The deal will help Hexo in becoming the number one market player in the Canadian recreational cannabis market. Shares jumped almost 10% to close at $7.18 on May 28.

Hexo engages in the manufacture, production, and distribution of medicinal marijuana.

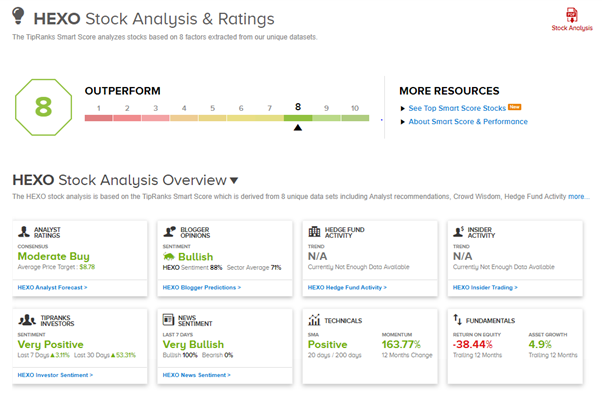

Per the terms of the agreement, Redecan shareholders will receive $400 million in cash and $525 million in the form of Hexo common stock at an implied price of $7.53 per share. (See Hexo stock analysis on TipRanks)

The $7.53 price represents the five-day VWAP (volume-weighted average price) of HEXO common shares on the Toronto Stock Exchange as of the close of Canadian markets on May 27, the company said.

The deal, which has been approved by Hexo’s Board, is expected to close in Q3 2021, subject to certain conditions and approvals. Upon closure of the deal, it is expected that Redecan shareholders will hold around 31% of Hexo’s common shares.

HEXO’s CEO and co-founder Sebastien St-Louis said, “We articulated a plan to become a top three cannabis player in the Canadian adult-use market …Building on our strong market momentum, the combination of HEXO and Redecan reinforces our position as an industry leader and creates a robust foundation for growth, efficiency at scale and improved financial results.”

In connection with the deal, HEXO sold $360 million worth of senior secured convertible notes due May 1, 2023, directly to an institutional purchaser and its affiliates. The company intends to use the majority of the sale proceeds to pay the cash portion of the Redecan acquisition.

Following the announcement of the deal, Oppenheimer analyst Rupesh Parikh assigned a Hold rating to HEXO stock.

Parikh said, “HEXO did not provide any specific financial details on revenue, synergies, etc., making it difficult to have a strong opinion on the combination. From an industry perspective, we look favorably upon the recent consolidation in the Canadian cannabis space, which we believe is essential for the longer-term health of the environment. For shorter-term players, the fundamental outlook remains quite challenging, in our view, driven in part by COVID-19 headwinds in Canada.”

Hexo shares have gained 160% over the past year, while the stock scores a Moderate Buy consensus rating based on 2 Buys and 6 Holds. That’s alongside an average analyst price target of $8.86, which implies 23.4% upside potential to current levels.

Hexo scores an 8 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Veeva Tops Q1 Expectations; Shares Jump 10%

Dell Delivers Blowout Q1 Results, Beat Expectations

Costco Q3 Earnings Beat Expectations; Street Says Buy