Great-West Lifeco (GWO) has announced it will present a virtual Investor Day focused on Empower Retirement, one of its U.S. subsidiaries. The event will take place on June 8, 2021, from 9:00 a.m. to 12:00 p.m. EST. Those interested in attending the event can register on the Lifeco website. Great-West Lifeco is an international financial services holding company with a focus on insurance.

Senior members of Empower Retirement, including Paul Mahon, Great-West Lifeco’s President and CEO, and Ed Murphy, Empower Retirement’s President and CEO, will be making presentations during the event. Analysts and institutional investors will have the opportunity to pose questions following the presentation.

The senior management team will provide insights into Empower Retirement’s growth opportunities and strategic priorities, including its positioning for growth in the wealth management market and defined contribution pension market. Additionally, they will also show how the company is leveraging the recent acquisition of MassMutual and Personal Capital.

Great-West Lifeco and its companies administer approximately C$2.1 trillion in consolidated assets. In addition, they are members of the Power Corporation (POW) group of companies. (See Great-West Lifeco stock analysis on TipRanks)

Empower Retirement provides financial services to businesses and individuals. The company administers approximately C$1 trillion in assets on behalf of over 12 million pension plan members.

About two weeks ago, BMO Capital analyst Tom Mackinnon maintained a Hold rating on GWO and a C$37.00 price target, for 0% upside potential.

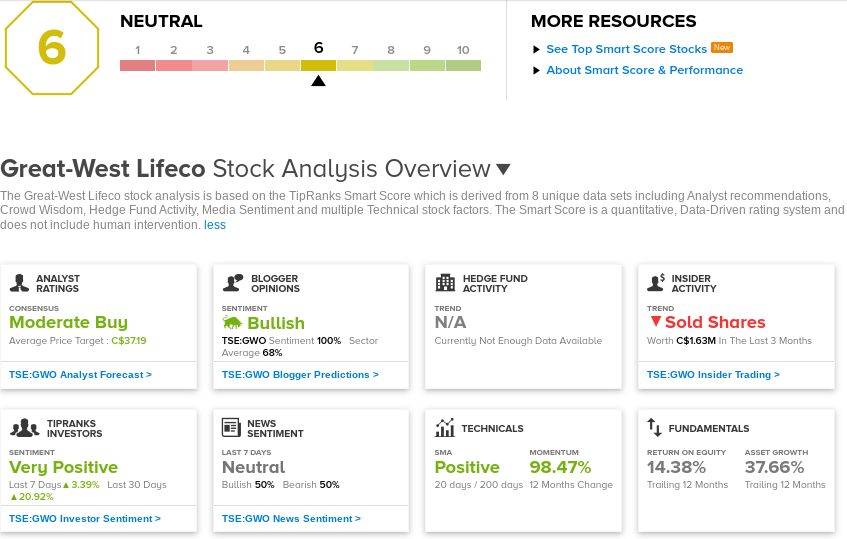

Consensus on the Street is that GWO is a Moderate Buy based on 2 Buys and 6 Holds. The average analyst price target of C$37.19 implies shares are fully priced at current levels. Shares have gained 22% year-to-date.

TipRanks’ Smart Score

GWO scores a 6 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock’s returns are likely to perform in line with the overall market.

Related News:

Power Corp Q1 Profit Nearly Triples, Beat Estimates

TMX Group Posts Better-Than-Expected 1Q Results, Boosts Dividend 10%

Manulife Donates C$250,000 To Support COVID-19 Initiatives In Asia