Alphabet (NASDAQ: GOOGL) revealed that it has acquired Siemplify, a cybersecurity startup based in Israel, according to Reuters. The deal aligns with tech giant Google’s long-term goal to bolster its security offerings to curb the upsurge in cyber attacks.

The financial terms of the deal have been kept under wraps. However, according to a Reuter’s source, Google has paid $500 million in cash for the acquisition.

Robust Demand for Cybersecurity Products

Notably, Google’s revenue from the cloud business almost doubled to around $5 billion since the COVID-19 pandemic began in 2020, as companies shifted to remote work from home options globally.

Concurrent with that, cybercrimes have also shot up, creating a strong demand for cybersecurity products to safeguard against growing security threats.

Earlier in August, Google has committed to U.S. President Joe Biden to make investments worth $10 billion in cybersecurity over the coming five years to address the issue of increasing cybercrimes.

Benefits from the Deal

Siemplify is a provider of cloud-native security orchestration, automation, and response (SOAR) solutions, helping security teams respond to cyberthreats with greater speed and precision.

Before the deal, it was in the middle of raising new capital after already raising $58 million from investors, including G20 Ventures and 83North.

The acquisition of Siemplify underpins the similar capabilities Google plans to invest in over the coming years. It will be integrated with Google’s cloud business.

Furthermore, the additions of Siemplify will help Google to utilize the pool of cybersecurity talent available in the Middle Eastern region.

Analyst’s Recommendation

On December 29, a CFRA analyst upgraded Alphabet from Buy to Strong Buy with a price target of $3,400 (17.7% upside potential).

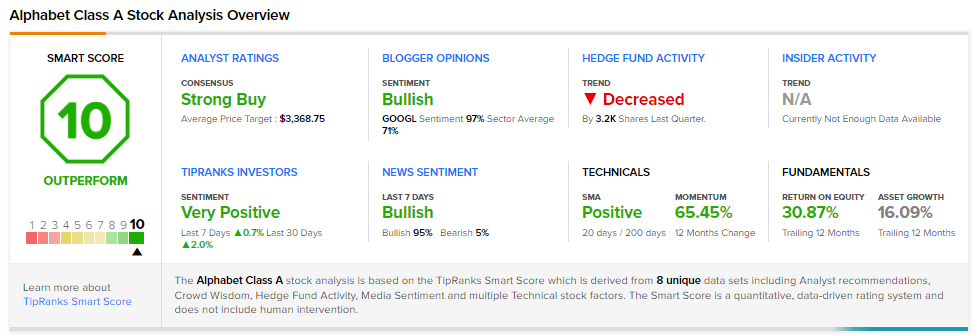

Consensus among analysts is a Strong Buy based on 26 Buys and 2 Holds. The average Alphabet price target of $3,368.75 implies 16.65% upside potential to current levels.

Smart Score

GOOGLE scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Download the TipRanks mobile app now

Related News:

Brown & Brown, Inc. Acquires Assets of HARCO

Lockheed Martin Reveals its F-35 Program Growth in 2021

Theranos CEO Elizabeth Holmes Found Guilty in a Lengthy Fraud Trial