Alphabet Inc’s Google (GOOGL) is allegedly abusing its market position to unfairly promote its mobile payments app in India according to a complaint submitted to the country’s antitrust watchdog.

Reuters reports that the complaint filed in February with the Competition Commission of India (CCI), alleges that the U.S. tech giant more prominently promotes its Google Pay app inside its Android app store in India, giving it an unfair advantage over apps of competitors which hurts consumers.

Android mobile operating platforms power around 98% of the 490 million smartphones in India, data from Counterpoint Research showed.

Google has reportedly been informed about the case being filed a few days ago and the company is expected to respond in due course.

The case filing is currently being reviewed by senior CCI members. In the next stage, Google may need to appear before the watchdog which will thereafter decide how to proceed.

This represent Google’s third major antitrust case in India. In 2018, the CCI fined Google $21 million for “search bias”, but a company appeal against that is pending. The CCI last year also started probing Google for allegedly misusing its dominant position to reduce the ability of smartphone manufacturers to opt for alternate versions of its Android mobile operating system.

Google Pay allows users in India to do inter-bank fund transfers and bill payments. It competes with apps such as Softbank-backed Paytm and Walmart’s PhonePe in India’s crowded digital payments market, where Facebook’s WhatsApp is also planning a similar service.

According to Google its payments app had rapidly grown in India to reach 67 million monthly active users, driving transactions worth more than $110 billion on an annualised basis.

Shares in Google have soared 25% over the past two months erasing all of their losses suffered earlier this year. The stock declined 0.8% to $1,410.36 in early afternoon trading.

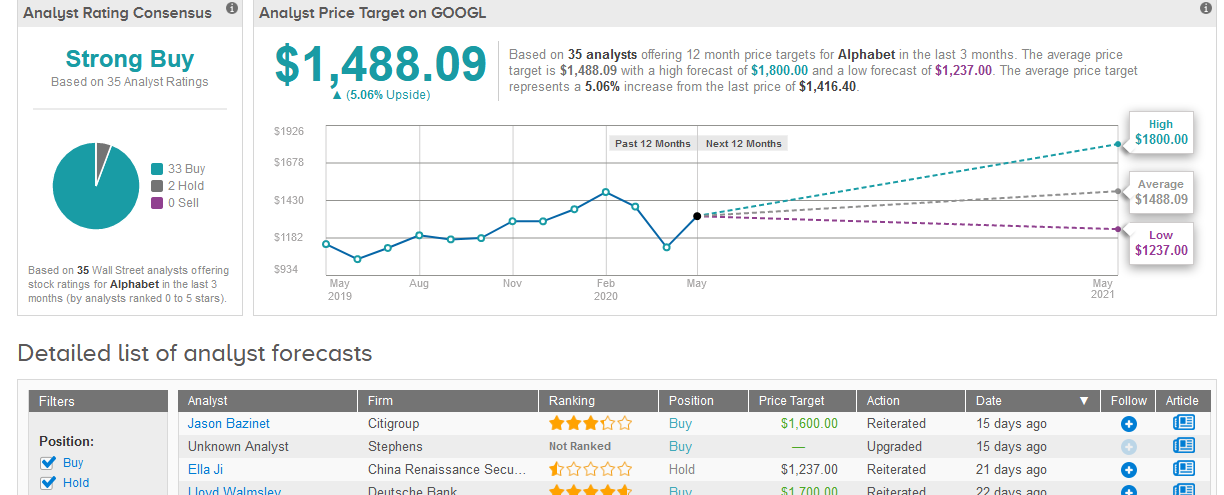

In view of the recent rally the stock’s upside potential is now expected to be more limited. The average analyst price target of $1,488.09 indicates shares have room to rise a mere 5.1% in the coming 12 months. (See Alphabet’s stock analysis on TipRanks).

The Wall Street outlook for Google remains bullish. The Strong Buy consensus boasts 33 Buy ratings with two analysts assigning Hold ratings, according to TipRanks data.

Related News:

Facebook Messenger Rolls Out Safety Alerts To Detect Scams, Protect Minors

Facebook Canada Faces C$9 Million Fine Over ‘False’ Privacy Claims

Google, Apple Roll Out Coronavirus Contact Tracing Technology