General Electric Co. (GE) said it reached an agreement to sell its unit GE Lighting to smarthome company Savant Systems Inc. for an undisclosed sum.

Shares in GE rose 8% to $7.35 in U.S. midday trading. The deal, which includes a long-term licensing agreement for the use of the GE brand, is still subject to customary closing conditions and is expected to close mid-2020.

“Today’s transaction is another important step in the transformation of GE into a more focused industrial company,” said GE Chairman and CEO H. Lawrence Culp. “Together with Savant, GE Lighting will continue its legacy of innovation, while we at GE will continue to advance the infrastructure technologies that are core to our company and draw on the roots of our founder, Thomas Edison.”

GE Lighting has a history of almost 130 years from the dawn of incandescent bulbs to industry-first LED and smart solutions along with the world’s first voice-embedded lighting product. Today, GE Lighting’s portfolio includes home lighting and smart home solutions. Following the closure of the transaction, GE Lighting will remain headquartered in Cleveland, Ohio, and its more than 700 employees will be transferred to Savant.

Shares in GE have been hit hard this year, dropping almost 40%. The sharp decline is mostly on account of GE’s heavy dependency on the commercial aviation sector, which has come to an almost standstill during the coronavirus pandemic. GE announced this month that it is cutting 25% of the workforce at its aviation unit, which makes engines for Boeing (BA) and Airbus.

The job cuts are part of recently announced cost-cutting plans. For the rest of the year, GE expects to reduce operational costs by more than $2 billion and save over $3 billion more in cash preservation measures.

Five-star analyst Stephen Tusa at J.P. Morgan, who has a Hold rating on the stock, says that 2020 is likely to be materially negative for FCF at a time when GE is not in a good position to withstand the current crisis.

“Yes, COVID-19 is a major factor, but it is for many others and the 1Q was a standout negative,” Tusa wrote in a recent note to investors. “Putting this aside, however, things are set to get materially worse near term, then not get better for a while, with a chance to get even worse as time goes on.”

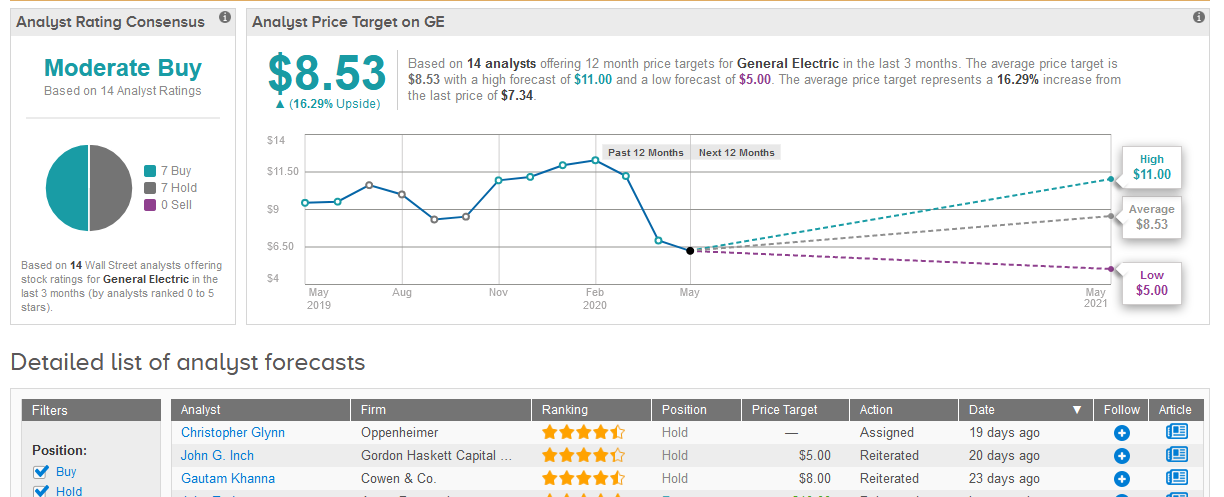

Tusa’s $5 price target puts the downside potential in the shares at 32% over the coming year. This compares with an average analyst price target of $8.50 per share.

The Street’s rating outlook for General Electric is currently split down the middle, with 7 Buy and 7 Hold ratings, adding up to a Moderate Buy consensus. (See GE stock analysis on TipRanks).

Related News:

Air Canada’s Proposed Takeover Of Transat Faces EU Anti-Trust Probe

Ryanair Cuts Traffic Target By Almost 50% For Coming Year, Seeks To Reduce Boeing Plane Deliveries

Boeing Gets No Orders in April, Customers Cancel 737 MAX Jets