On April 13, Galiano Gold reported preliminary 1Q 2021 operating results for the Asanko Gold Mine (AGM), which is located in Ghana, West Africa.

The AGM is a 50-50 joint venture with Gold Fields (GFI), operated and managed by Galiano Gold (GAU). All of the reported financial information is unaudited and reported in US dollars.

In the first quarter, a $10 million cash distribution was paid to the joint venture partners ($5 million to Galiano). Gold revenue of $110.6 million was generated by 62,925 ounces sold at an average realized price of $1,757 per ounce. Gold production was 59,999 ounces, in line with the 2021 forecast.

Galiano’s CEO Greg McCunn said, “The Asanko Gold Mine delivered another solid operational quarter and with continued metal price strength was in a position to make a $10 million distribution to the JV partners, allowing Galiano’s balance sheet to remain strong with approximately $65 million in cash and receivables as at March 31st and no debt. The exploration programs at the AGM continue to remain a focus area with step out drilling at Miradani underway. Additionally, as a result of the successful 2020 exploration program, we are advancing stripping at Akwasiso Cut 3.”

Galiano plans to release full financial and operational results after market close on May 5, 2021. (See Galiano Gold stock analysis on TipRanks)

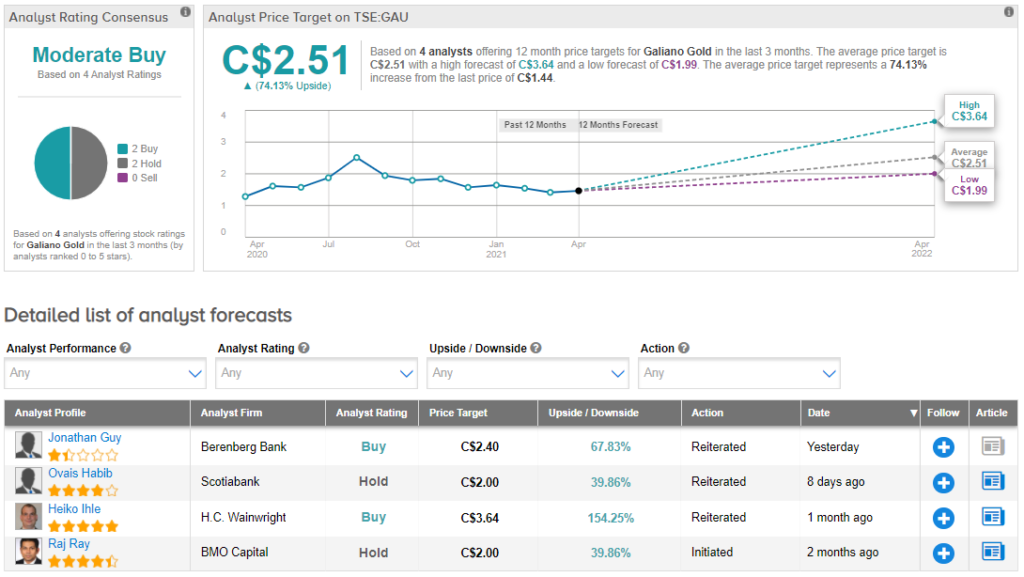

Following the preliminary results, Berenberg Bank analyst Jonathan Guy reiterated a Buy rating on Galiano and a C$2.40 price target (68% upside potential).

Last week, Scotiabank analyst Ovais Habib reiterated a Hold rating on the stock but lowered the price target to C$2 from C$2.25 (40% upside potential).

Overall, Galiano Gold has a Moderate Buy consensus rating on the Street, based on 2 Buys and 2 Holds. The average analyst price target of C$2.51 implies upside potential of about 74% to current levels.

Related News:

Aphria’s 3Q Sales and EPS Miss Estimates; Shares Plunge 14%

Summit Industrial Income REIT Completes C$250M Green Bond Offering

OrganiGram Holdings’ 2Q Revenue Misses Estimates; Shares Plunge 10%