Popular sports-focused live TV streaming service fuboTV Inc. (FUBO) released preliminary results for its fourth quarter of fiscal year 2021 and also gave out subscriber metrics. FUBO earnings date for the fourth quarter is scheduled for June 13, 2022.

Despite forecasting upbeat Q4 numbers, shares sank as much as 8.4% marking a new yearly low of $12.79, and ended the day down 2.9% at $13.56 on January 10.

Upbeat Q4 Guidance

For Q4, fuboTV expects total revenue to fall between $215 million and $220 million, a 105%-109% year-over-year growth. This includes Advertising revenue of more than $25 million, and improvement in the subscriber churn out of more than 200 basis points. Meanwhile, the consensus estimate is pegged lower at $211.6 million.

Moreover, for Q4, the Subscriber Acquisition Cost (SAC) is projected at 1.0-1.5x monthly Average Revenue Per User (ARPU). For the full year 2021, FUBO expects total revenue to be between $622 million and $627 million, growing 138%-140% annually.

Additionally, year-end subscribers are expected to cross 1.1 million more than doubling the prior year’s numbers.

CEO Comments

Co-founder and CEO of FUBO, David Gandler, said, “In the fourth quarter, we continued to deliver triple-digit revenue growth, alongside operating leverage, through the efficient deployment of acquisition spend and the retention of high-quality customer cohorts. This was evidenced by continued improvements in subscriber churn year-over-year within the quarter.”

Gandler concluded, “We are also very pleased with the ongoing integration of Molotov, the Paris-based live TV streaming platform we acquired in December. While still early, our progress to date continues to reinforce our belief that the synergies of the combined companies will give us operating leverage to build a scalable global platform with minimal incremental spend.”

Analysts’ Take

Responding to FUBO’s preliminary results, Roth Capital analyst Darren Aftahi reiterated a Buy rating on the stock with a price target of $28, which implies a whopping 106.5% upside potential to current levels.

Aftahi said, “We continue to view the risk/reward on FUBO as attractive with shares now trading sub. 2X FY22 sales despite ~77% growth, well above the peer mean of ~37%, although most peers are profitable… That said, we believe FUBO’s continued subscriber growth outperformance could pave the way to better operating leverage if Ad ARPU continues to perform to the upside and churn/SAC metrics continue to fall y/y.”

Overall, the stock has a Moderate Buy consensus rating based on 6 Buys and 3 Holds. The average fuboTV price target of $41.29 implies a massive 204.5% upside potential to current levels. However, shares have lost 62.8% over the past year.

Website Traffic

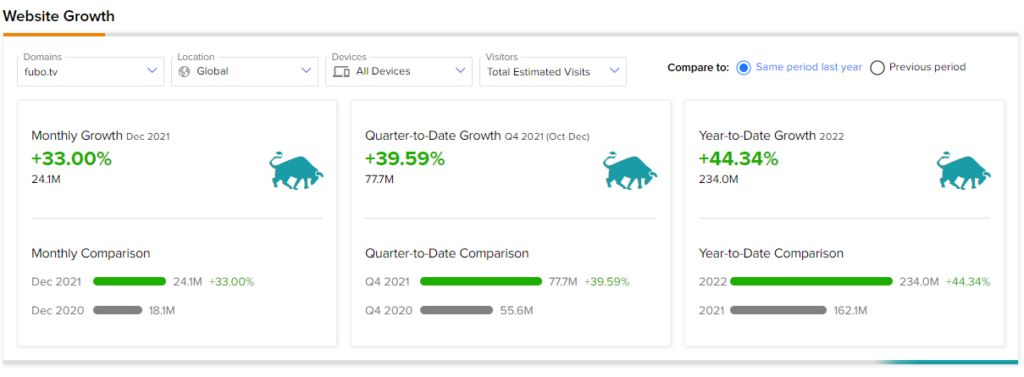

TipRanks’ Website Traffic tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into FUBO’s performance.

In December, fuboTV website traffic recorded a 33% year-over-year increase in monthly visits. Similarly, year-to-date website traffic growth increased by 44.34% compared to the same period last year.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Download the TipRanks mobile app now

Related News:

Tesla Hikes Price on Full Self-Driving to $12K

Roblox Sinks 7% on News of Removing China App

Microsoft & Google Shares Witness Worst Drop since Pandemic