Ford shares gained over 3% on Monday after it announced that it would be closing its production operations in Brazil in 2021. Ford’s South American headquarters and product development centers will remain in Brazil but vehicles will be sourced from Argentina, Uruguay and other markets.

Ford (F) is evaluating its businesses around the world and restructuring in ways that advance Ford’s plan to increase its profit margins and free up cash flow.

Ford’s plans to revamp its automotive business include simplifying and modernizing all aspects of the company by building on its existing strengths and partnering with others to gain expertise and improve efficiency.

“We know these are very difficult, but necessary, actions to create a healthy and sustainable business,” said Jim Farley, Ford president and CEO. “We are moving to a lean, asset-light business model.”

Ford will start engaging immediately with employee unions and other stakeholders to develop an “equitable and balanced plan to mitigate the impacts of ending production.” (See F stock analysis on TipRanks)

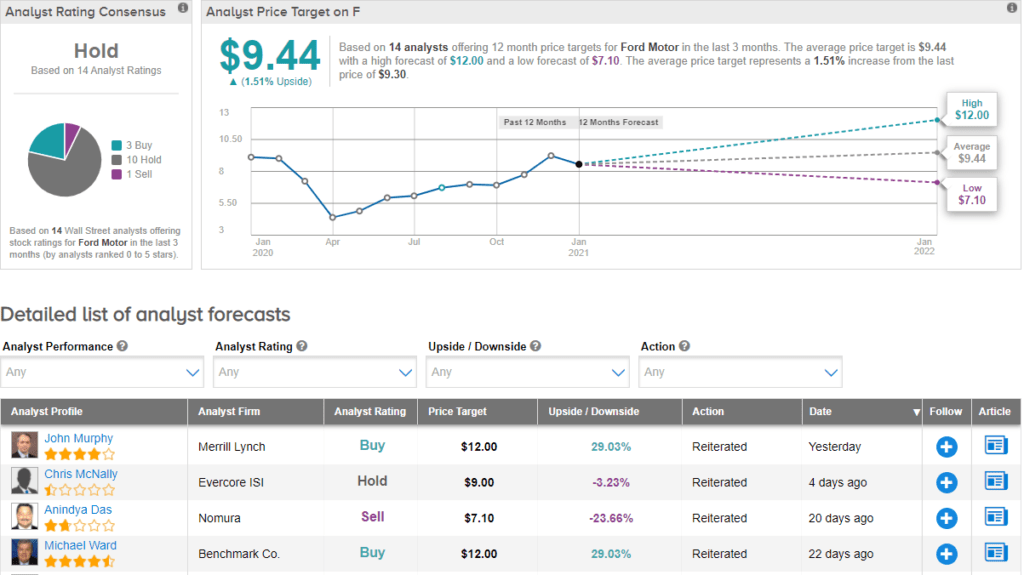

Benchmark analyst Michael Ward reiterated his Buy rating on Ford three weeks ago and raised his price target from $11 to $12. This implies upside potential of around 30% from current levels.

Ward specifically cites Ford’s restructuring plans and improving North America industry sales as catalysts for strengthening Ford’s financial position over the next couple of years.

Consensus among analysts is a Hold based on 3 Buys, 10 Holds and 1 Sell. The average price target of $9.44 suggests that Ford shares are fully priced at current levels.

Related News:

Abercrombie Soars 7% On Improved 4Q Sales Outlook

Acacia’s 4Q EPS Outlook Beats Estimates; Files Counterclaim Against Cisco

Bristol-Myers To Buy Back Another $2B In Stock