Foot Locker (FL) rose almost 2% to close at $60.87 on May 21 when the company announced stronger-than-expected first-quarter results. The company is an American sportswear and footwear retailer.

The company reported total revenue of $2.15 billion that exceeded the consensus estimates of $1.86 billion. Moreover, the top-line increased 83.1% year-over-year.

Comparable store sales in the first quarter increased 80.3% year-over-year.

Adjusted earnings came in at $1.96 per share compared to a net loss of $0.67 per share in the year-ago quarter. Analysts were expecting the company to report earnings of $1.05 per share.

Foot Locker CEO Richard Johnson said, “With strong product tailwinds, we remain optimistic about our category and our ability to drive long-term growth, profitability and shareholder value.” (See Foot Locker stock analysis on TipRanks)

Following the Q1 earnings release, Berenberg Bank analyst Brian McNamara reiterated the stock’s price target of $67 (10.1% upside potential) and a Buy rating.

McNamara commented, “A robust Q1 relative to low expectations, but we believe buy-side expectations had risen into the print. With clear tailwinds in the business (stimulus and easy comps), we believe results could have been better. Pandemic restrictions and port issues were likely headwinds and we look forward to hearing some of the puts and takes on this morning’s earnings call.”

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 7 Buys and 7 Holds. The average analyst price target of $64.14 implies 5.4% upside potential to current levels. Shares have increased 56.4% over the past six months.

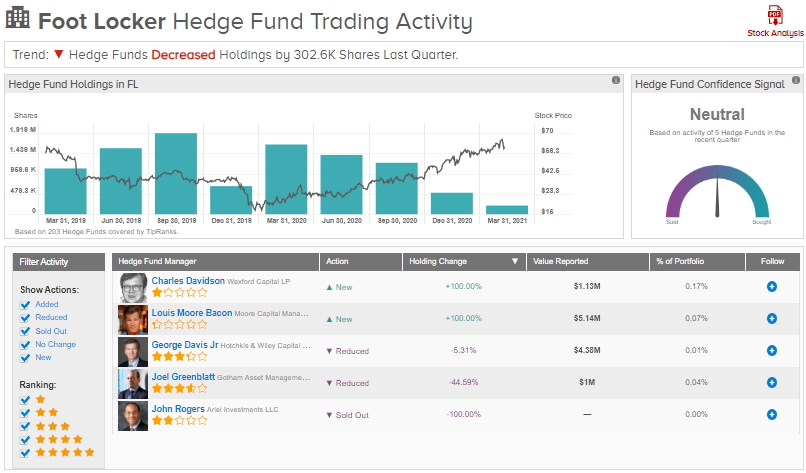

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Foot Locker is currently Neutral, based on the activity of 5 hedge funds in the recent quarter. In an overall trend, hedge funds decreased their cumulative holdings of the stock by 302,600 shares in the last quarter.

Related News :

Ashland Bumps up Quarterly Dividend By 9%

Home Depot to Buy Back $20B in Stock; Street Says Buy

Criteo Enhances Retail Media Business with Mabaya Buyout