Specialty discount retailer Five Below, Inc. (FIVE) delivered a blowout quarter with both earnings and revenue outpacing the Street’s expectations driven by elevated consumer demand. Shares jumped around 6% in extended trading on June 3.

Earnings for the quarter stood at $0.88 per share, beating analysts’ estimates of $0.65 per share. The company reported a loss of $0.91 per share in the prior-year period.

Net sales came in at $597.8 million, up 197.6% year-over-year, and surpassed the Street’s estimates of $551.14 million.

Comparable sales grew 162% year-over-year. At quarter-end, the company operated 1,087 stores in 39 states, including 67 net newly opened stores. (See Five Below stock analysis on TipRanks)

Joel Anderson, President and CEO of the company said, “We are on track to open 170 to 180 new stores this year and offer our unique Five Below experience to more new customers. With the inherent flexibility of our eight worlds, unique merchandising approach and focus on innovation, we believe we remain in a position of strength to continue growing Five Below and driving sustainable, long-term value for all stakeholders.”

For the fiscal second quarter, the company forecasts net sales and earnings to fall in the range of $640 million to $660 million and $1.01 – $1.13 per share, respectively. The Street estimates revenue of $584.3 million and earnings of $0.71 per share.

Following the Q1 results, Berenberg Bank analyst Brian McNamara reiterated a Hold rating on the stock and stated, “Estimates will move higher on the implied H1 performance, but there remains considerable uncertainty as to how the cycling of difficult comps in H2 will play out as external tailwinds fade. FIVE continues not to offer full year guidance for a reason, in our view.”

The analyst assigned a price target of $162 on the stock, which implies 11.9% downside potential.

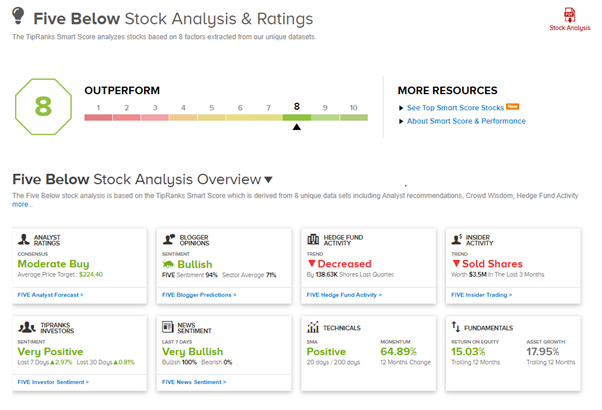

The stock has a Moderate Buy consensus rating based on 11 Buys and 4 Holds. The average analyst price target of $228.47 implies 24% upside potential from current levels. Shares have gained 68.1% over the past year.

Five Below scores an 8 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

J.M. Smucker Tops Q4 Results; Shares Gain

Ciena Delivers Stronger-than-Expected Q2 Results; Shares Pop 7%

Semtech Reports Robust Q1 Results, Beats Expectations