FirstService Corporation (FSV) shares rose more than 2% after the property services provider reported better-than-expected EPS and revenue in its first quarter.

Consolidated revenues came in at $711.1 million for the quarter ended March 31, an increase of 12% from $633.8 million last year. 1Q 2021 GAAP EPS was $21.9 million ($0.50 per share), compared to $5.3 million ($0.13 per share) in 1Q 2020.

FirstService earned $0.66 per share in the first quarter, up 78% from $0.37 per share a year ago on an adjusted basis. Analysts, on average expected adjusted earnings of $0.25 per share and $401.83 million in revenue.

FirstService’s CEO Scott Patterson said, “We are pleased to have kicked off the year with a strong first quarter. We saw growing momentum in our home improvement brands and capitalized on increased restoration activity, while our FirstService Residential platform showed continued strength and resilience in countering the impact of the pandemic.”

FirstService has not released any earnings or revenue guidance at this time. (See FirstService Corporation stock analysis on TipRanks.)

In February, RBC Capital analyst Matt Logan reiterated a Hold rating on the stock while raising its price target to C$160.00 (25.3% downside potential) from C$135.00.

Logan said in a note that the company has successfully executed its five-year plan by doubling the size of its business while capitalizing on the resiliency of its business model, organic growth, and its ability to integrate acquisitions. He added that FirstService has what it takes to double its revenue again in 2020-2025.

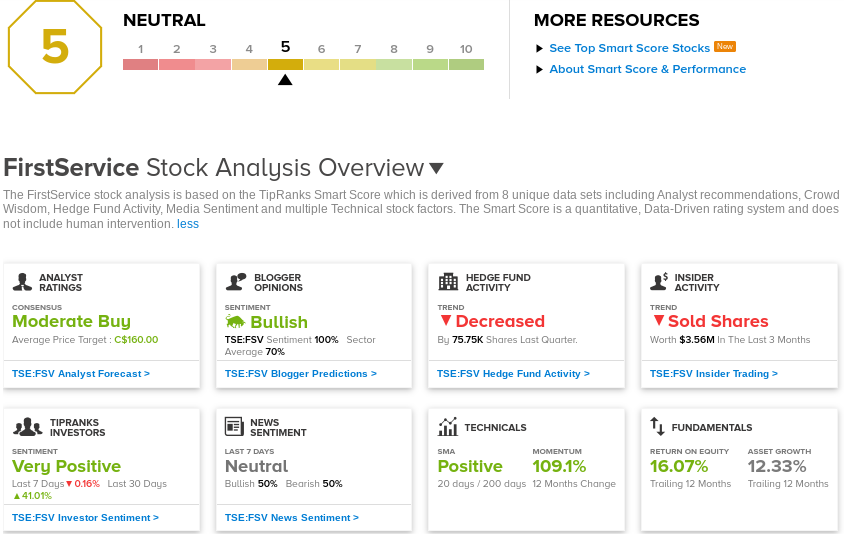

Overall, the consensus on the Street is that FSV is a Moderate Buy based on 1 Buy and 1 Hold. The average analyst price target of C$160.00 implies a downside potential of about 25.3%. Shares have jumped by more than 25% since the start of the year.

In addition, FSV scores a 5 out of 10 on the TipRanks Smart Score rating system, indicating that the stock should perform in line with the overall market.

Related News:

Fire & Flower Revenue Rises 147% in 4Q; Shares Pop 8%

Canadian National Railway Misses On Revenue In 1Q

CareRx Enters Deal With Rexall To Add 4,200 Beds