Bristol Myers Squibb, a biopharmaceutical company, announced that the US Food and Drug Administration (FDA) has accepted its New Drug Application (NDA) for mavacamten, an investigational, novel, oral, allosteric modulator of cardiac myosin. The drug is designed for the treatment of symptomatic obstructive hypertrophic cardiomyopathy (oHCM).

Bristol Myers Squibb’s (BMY) Cardiovascular Development Senior VP Roland Chen said, “Today’s acceptance from the FDA puts us one step closer to having a highly targeted therapeutic approach for oHCM, as mavacamten is a first-in-class myosin inhibitor developed to address the underlying molecular defect of the disease.”

The acceptance of the application followed the results of the pivotal Phase 3 EXPLORER-HCM trial, which evaluated the efficacy of mavacamten in patients with symptomatic oHCM, compared to placebo. A Prescription Drug User Fee Act (PDUFA) target date of Jan. 28, 2022 has been assigned by the FDA.

Hypertrophic cardiomyopathy is a disease which can lead to debilitating symptoms and cardiac dysfunction due to excessive contraction of the heart muscle and reduced ability of the left ventricle to fill. This disease affects 160,000 to 200,000 people across the US and EU, and there is a lack of effective drug treatment options beyond limited symptomatic relief, the company said. (See Bristol Myers Squibb stock analysis on TipRanks)

On March 17, Merrill Lynch analyst Geoff Meacham maintained a Buy rating and a price target of $80 (27.6% upside potential).

Meacham said, “The biggest crux of our bull thesis is the new launch portfolio, with 8 new or upcoming launches that have >$20B potential and a number of line extensions. There’s still hesitancy from investors to give much credit to some of the newer/upcoming launches (i.e., Zeposia, cell therapies, mavacamten, TYK2) but we think that would change if management can deliver strong initial commercial execution – which could drive peak numbers higher and restore confidence in the LT outlook.”

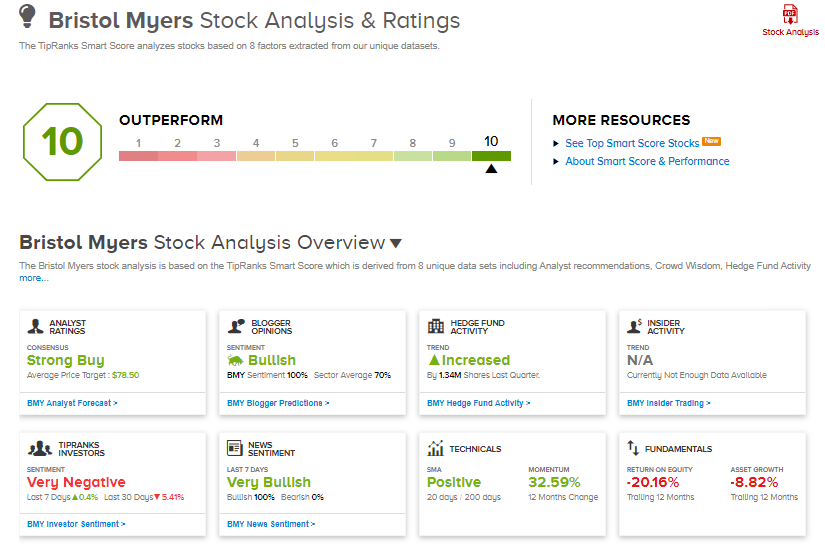

The consensus rating among analysts is a Strong Buy based on 4 unanimous Buys. The average analyst price target stands at $78.50 and implies upside potential of 25.2% to current levels. Shares have gained 35% over the past year.

What’s more, Bristol Myers Squibb scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

FedEx Posts Better-Than-Expected 3Q Results As Sales Outperform; Shares Gain 4.4%

Ollie’s 4Q Results Beat Analysts’ Expectations As Sales Pick Up; Shares Gain After-Hours

Kiniksa Wins FDA Nod For ARCALYST Injection therapy; Shares Pop After-Hours