Encompass Health Corporation (EHC) issued a notice to redeem $100 million worth of its 5.125% senior notes due in 2023. Encompass Health is one of the largest providers of post-acute healthcare services in the United States.

Encompass Health stated that the total amount to be paid upon redemption would be equal to the principal amount of the notes outstanding, plus any accrued and unpaid interest, according to the terms of the 2023 notes.

The notes will be redeemed on June 30. The company plans to fund the redemption through a combination of cash in hand and debt under its revolving credit facility.

Encompass Health anticipates a loss on early extinguishment of debt amounting to nearly $0.5 million in Q22021 as a result of the redemption.

On April 27, Encompass Health posted better-than-expected Q1 results. The company reported adjusted earnings of $1.05 per share which came in well ahead of analysts’ expectations of $0.82 per share. Revenue of $1.23 billion met the consensus estimate. (See Encompass Health stock analysis on TipRanks)

Following the Q1 earnings announcement, Raymond James analyst John Ransom reiterated a Buy rating on the stock and increased the stock’s price target to $95.00 from $90.00. This implies approximately 10.7% upside potential from current levels.

Ransom commented, “Management raised their 2021 outlook primarily to reflect the extension of the sequestration holiday through year-end, which accounted for essentially all of the increase in revenue guidance, while underlying core performance accounted for ~2% the adjusted EBITDA increase.”

“Given management’s guidance assumes a back-end weighted recovery, if COVID cases continue to decline and elective procedures are in line with what peers around the industry have seen in March and April we would expect to continue to see better than expected results for EHC. However, we continue to expect shares to trade range-bound as we await an update with the 2Q earnings release (in July) on the ongoing evaluation of strategic alternatives for the home health and hospice businesses,” the analyst added.

Consensus among analysts is a Strong Buy based on 5 unanimous Buys. The average analyst price target stands at $98.20 and implies upside potential of 14.5% to current levels. Shares have gained 15.8% over the past year.

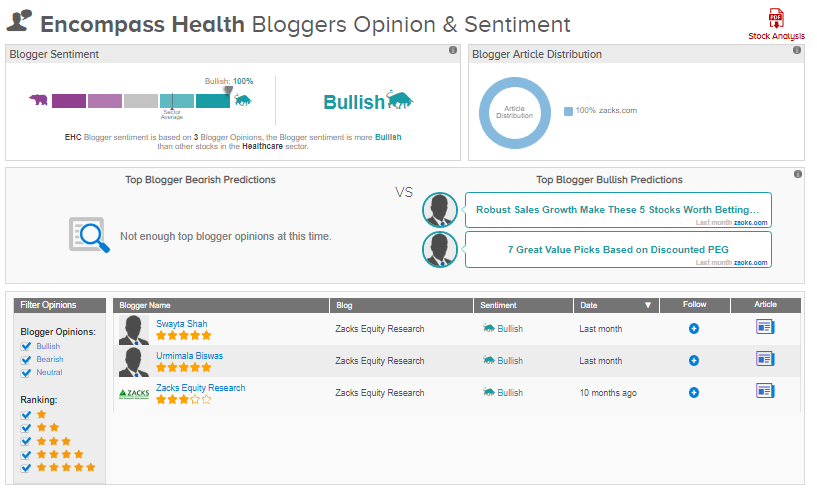

TipRanks data shows that financial blogger opinions are 100% Bullish on EHC, compared to a sector average of 68%.

Related News:

Westport to Snap up Stako for €5M; Street Says Buy

Black Knight Inks $250M Deal with Top of Mind Networks, Drive Marketing Automation

LyondellBasell Bumps up Quarterly Dividend by 7.6%

Best Dividend Stocks For 2021