Shares of the global healthcare company, Eli Lilly and Company (LLY) reached a new all-time high of $275.54, after the company impressed investors at its Investment Community Meeting. The pharmaceutical giant raised its FY21 outlook on the heels of boosted COVID-19 therapy sales, and also initiated upbeat guidance for FY22.

Additionally, the company provided an outlook on newer medicines and upcoming launches, which are expected to drive breakthrough sales for the company in the coming decade. Shares jumped 10.4%, closing at $275.28 on December 15.

Revised FY21 Guidance

For full-year fiscal 2021, Lily has revised its estimates and forecasts revenue to fall between $28 billion and $28.3 billion. The revised guidance reflects additional orders for the company’s COVID-19 antibodies with the U.S. Government and the updated 2022 NRDL formulary in China. Revenue from COVID-19 antibodies is now expected at $2.1 billion.

Meanwhile, Non-GAAP earnings are now projected to be between $8.15 per share and $8.20 per share, reflecting a growth of 20%-21% compared to the comparable prior-year period.

Upbeat FY22 Guidance

Based on the underlying business momentum and demand, the company provided upbeat guidance for full-year Fiscal 2022.

For FY22, revenue is projected to be between $27.8 billion to $28.3 billion. The company expects its key growth products to contribute two-thirds of core business revenue, excluding sales from COVID-19 therapies.

Moreover, non-GAAP earnings are expected to fall in the range of $8.50 per share to $8.65 per share.

Management Comments

Lilly’s Chief Scientific and Medical Officer, and President of Lilly Research Laboratories, Daniel Skovronsky, said, “I’m very optimistic about the future for Lilly and the patients we serve. In addition to our promising late-stage pipeline, our labs are making new discoveries to bring life-changing medicines to patients who need them… Lilly has significantly improved our development speed and clinical success rates and will continue to apply this focus as we work to maximize the impact of our existing medicines and create new ones.”

Analysts’ View

Responding to the news, Mizuho Securities analyst Vamil Divan said, “Investor concerns on Lilly’s ability to grow the bottom-line next year as they invest in new launches should be allayed, with the company expecting to modestly increase SG&A and R&D spend, but also increase operating margins to ~32% (from ~30% this year).”

Divan noted that Lily’s non-GAAP EPS guidance of $8.50-$8.65 is well above his estimate of $8.11 and also above the current sell-side consensus at $8.21.

Divan maintained his Buy rating with a price target of $272 on the stock, which implies 1.2% downside potential to current levels.

Overall, the stock commands a Strong Buy consensus rating based on 8 Buys and 2 Holds. The average Eli Lilly price target of $283.70 implies 3.06% upside potential to current levels. Shares have gained 60% over the past year.

Blogger Opinion

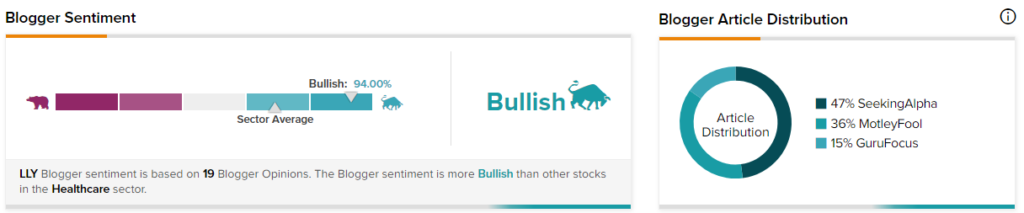

TipRanks data shows that financial blogger opinions are 94% Bullish on LLY, compared to a sector average of 69%.

Related News:

Netflix Slips on India Price Cuts

Stocks on TSX Composite Index Rake in Huge Returns

Pfizer Vaccine Less Effective on Omicron in South Africa