Shares of Dropbox increased 4.1% after the software company inked a deal to acquire DocSend, a secure document sharing and analytics company, in a cash deal worth $165 million.

Dropbox (DBX) said that the acquisition will complement the company’s product roadmap as a rise in remote work has led to a surge in demand for digital tools, which help individuals organize their content and collaborate. Notably, DocSend has a customer base of more than 17,000.

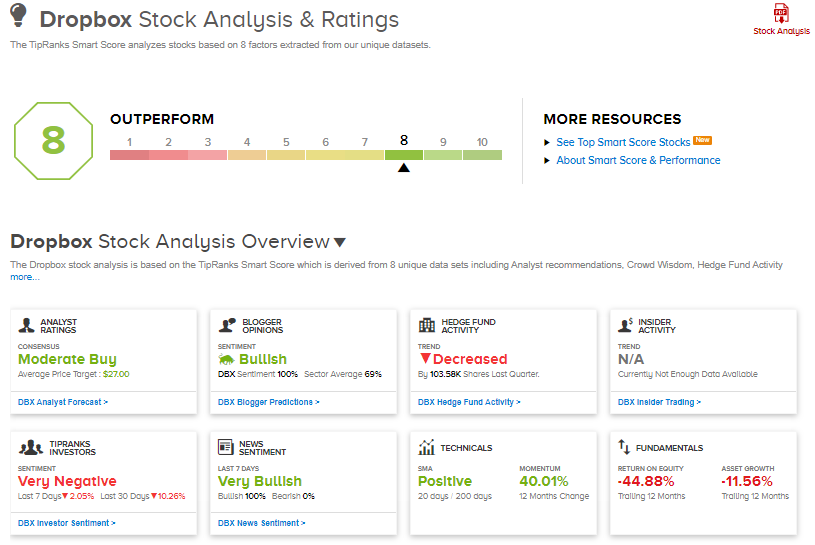

The transaction is expected to close in the first quarter of 2021 and is likely to have no material impact on the company’s operating results this year. (See Dropbox stock analysis on TipRanks)

Dropbox CEO Drew Houston said, “By bringing Dropbox, HelloSign, and DocSend together, we’ll be able to offer a full suite of secure, self-serve products to help them manage critical document workflows from start to finish.”

On Feb. 19, Monness analyst Brian White reiterated a Hold rating.

The analyst said, “Given the longer-term implications from this crisis around how we work, the ramp of new Dropbox innovations, the stock’s modest valuation and attractive operating margin expansion, Dropbox may tempt value-oriented investors.”

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 3 Buys, 2 Holds, and 1 Sell. The average analyst price target of $27 implies 9% upside potential to current levels. Shares have increased 25% over the past six months.

Dropbox scores an 8 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

DuPont Inks $2.3B Deal To Snap Up Laird Performance Materials; Shares Gain

Coherent Determines Revised Buyout Offer From II-VI To Be Financially Best Fit

Chevron Inks Deal To Buy Noble Midstream Partners; Shares Gain 4%