Shares of DraftKings jumped 4.8% after the sports betting company announced the acquisition of Vegas Sports Information Network, Inc. (VSiN), a multi-platform broadcast and content company. The financial terms of the deal were not disclosed.

Through this acquisition, DraftKings’ (DKNG) content capabilities will be enhanced and VSiN’s ability to grow its audience alongside the expansion of legal sports betting in the US will increase, the company said. Notably, DraftKings is live with mobile and/or retail sports betting in 14 states and VSiN has delivered trusted sports betting news, analysis, and data to US sports bettors since 2017.

DraftKings CEO Jason Robins said, “VSiN creates authentic and credible content that resonates with sports bettors at every level, whether they’re experienced or new to sports betting.”

“In addition to its brand equity among sports bettors and engaging talent roster, VSiN also has an established infrastructure that DraftKings can immediately help expand, in the hopes of adding value to consumers who are looking to become more knowledgeable about sports betting,” Robins added. (See DraftKings stock analysis on TipRanks)

DraftKings expects Brian Musburger, the CEO of VSiN, and his leadership team to continue to handle day-to-day activities. Furthermore, the company plans to fully integrate VSiN’s current staff base located in Las Vegas, including its on-air talent, into its existing global workforce of 2,600 individuals.

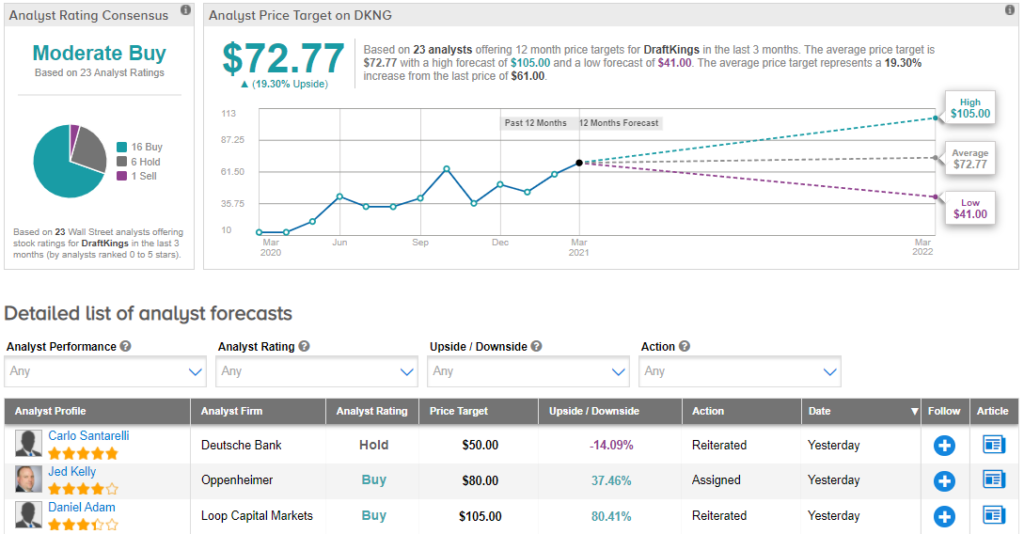

Following the deal, Oppenheimer analyst Jed Kelly maintained a Buy rating and a price target of $80 (31.2% upside potential).

Kelly said, “We are incrementally positive on the acquisition as we believe it positions DKNG to 1) further build out its content capabilities to a sports betting centric content consumer; 2) make a broader push into streaming; 3) deepen their presence in Las Vegas; and 4) create unique betting products integrated with VSiN content and personalities.”

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 16 Buys, 6 Holds, and 1 Sell. The average analyst price target of $72.77 implies 19.3% upside potential to current levels. Shares have skyrocketed 394.3% over the past year.

Related News:

Millendo To Merge With Tempest Therapeutics; Shares Tank

Fly Leasing To Be Acquired By Carlyle Aviation Partners For $2.36B; Shares Pop 28%

McCormick’s 1Q Results Beat Expectations As Sales Outperform