Dover Corporation (DOV), a diversified manufacturer of industrial products, delivered solid third-quarter results. Despite the ongoing challenging supply-chain and labor environment, Dover witnessed continued demand for its products, and its team managed to execute well. Shares jumped as much as 4.5% on the news before closing the day almost flat at $167.91 on October 19.

The company reported adjusted earnings of $1.98 per share, up 24% year-over-year, and beat Street estimates of $1.87 per share. (See Insiders’ Hot Stocks on TipRanks)

To add to that, revenue climbed 15% year-over-year to $2.02 billion and came in marginally better than consensus estimates of $2.01 billion.

Commenting on the results, Richard J. Tobin, President, and CEO of Dover said, “During the quarter we demonstrated the strength of our portfolio with revenue and new order growth across all five of our operating segments… As we enter the final quarter of the year, we do not anticipate the challenges from the third quarter to abate and therefore we remain focused on operational execution to deliver against robust demand in this strained operational environment.”

Based on continued business momentum and high backlog levels, Dover raised its full-year 2021 earnings outlook to $7.50 per share versus consensus estimates of $7.42 per share.

In response to Dover’s quarterly performance, Oppenheimer analyst Bryan Blair reiterated a Hold rating on the stock and said, “An unsurprising beat given Dover’s robust operating momentum, and we expect investors to look beyond an implied 4Q guide-down. We look for further momentum in Dover’s portfolio management (scaling core growth platforms, pruning non-core assets) and/or a pullback in valuation to move off the sidelines.”

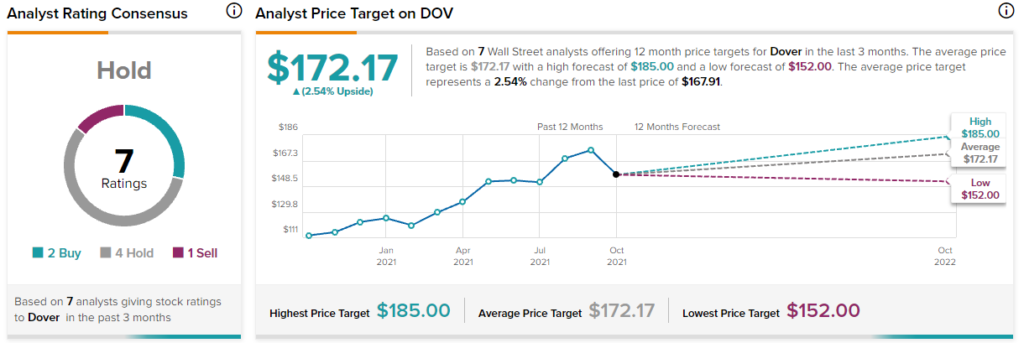

Overall, the stock has a Hold consensus rating based on 2 Buys, 4 Holds, and 1 Sell. The average Dover price target of $172.17 implies 2.5% upside potential to current levels. Shares have gained 47% over the past year.

Related News:

Fiserv Acquires BentoBox to Expand Digital Storefront Capabilities

PacWest Bancorp Slips 6.5% After-Hours Despite Beating Q3 Expectations

Steel Dynamics Delivers Solid Q3 Results; Shares Rise After Hours