Diamondback Energy (FANG) has provided an operational update for the third quarter of 2020- and reaffirmed guidance for the fourth quarter.

The company announced production of 287.3 Mboe/d (170 Mb/d oil) in line with the Street Consensus 285 Mboe/d (171 Mb/d oil). Capital spending of $281 million was above the Street’s $245 million forecast. Accrual based capital spending was $206 million.

Meanwhile realized prices (including hedge impacts) of $26.22/boe came in strong due to better natural gas liquids and natural gas price realizations.

During the quarter, FANG drilled 32 gross operated horizontal wells and turned 41 wells to production in the third quarter. FANG exited the third quarter with $0 drawn on its revolving credit facility and over $2 billion of liquidity.

Looking forward, 4Q20 production guidance of 280-290 Mboe/d (170-175 Mb/d oil) and full year capital spending guide of $1.8-1.9 billion was reiterated.

The company also believes it can maintain 4Q20 oil production in 2021 with 25-35% less capital spending than in 2020, consistent with prior commentary.

Oil hedge for 2021 of 87.4 Mb/d is largely unchanged from the prior position, while the natural gas hedge for 2021 rose 12% to 190 MMcf/d.

“After returning curtailed production in a second quarter that included minimal completion activity due to a historic decline in commodity prices, Diamondback returned to work in the third quarter to stem production declines and stabilize our production base” stated Travis Stice, CEO of Diamondback.

“As expected, production bottomed in the third quarter and is set to rise slightly in the fourth quarter to meet our fourth quarter production target of between 170,000 and 175,000 barrels of oil per day” he added.

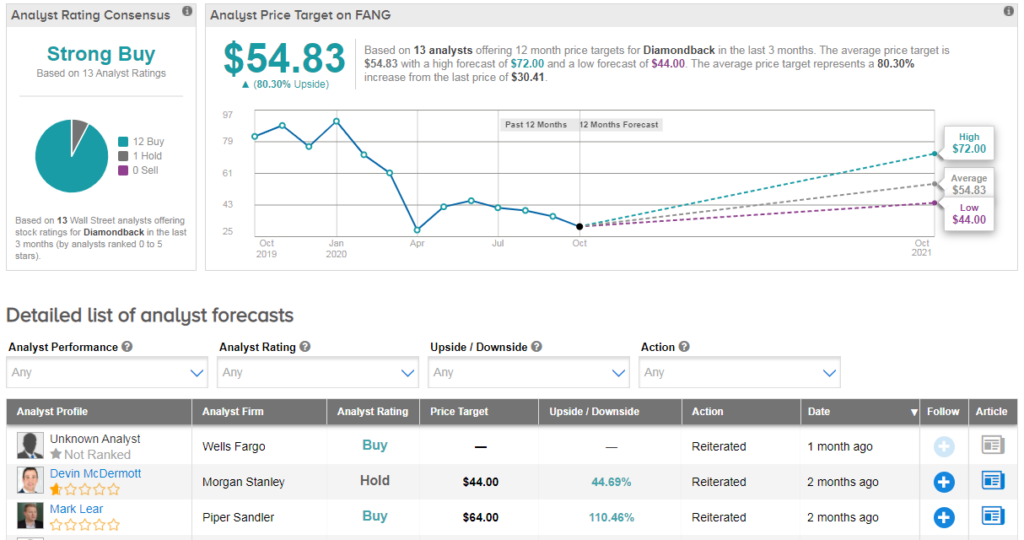

Shares in Diamondback have plunged 67% year-to-date, but the stock still scores a bullish Strong Buy Street consensus. That’s with 12 recent buy ratings vs just 1 hold rating. Meanwhile the average analyst price target of $55 indicates 80% upside potential from current levels.

Following the update, RBC Capital analyst Scott Hanold reiterated his FANG buy rating with a $50 price target (64% upside potential).

“Production was in line with expectations but higher price realizations should be a positive for FCF generation. Capital spending was similar to our model but it is above Street estimates, which we think were largely inconsistent with prior management commentary” the analyst commented.

He told investors: “The announcement should be viewed as slightly positive with the affirmed outlook.” (See FANG stock analysis on TipRanks)

Related News:

BlackRock Gains 4% On 3Q Profit Beat; Street Says Buy

PerkinElmer Raises 3Q Sales Outlook Fueled By COVID-19 Testing Demand

GM China 3Q Vehicle Sales Jump 12%; Merrill Lynch Sees 87% Upside