Shares of Crocs jumped 11% in the pre-market session on Tuesday as the shoe manufacturing company posted strong 1Q results. Record revenue growth of 64% along with outstanding performance in all regions and channels drove the stellar performance.

Crocs’ (CROX) 1Q adjusted earnings of $1.49 per share surged significantly on a year-over-year basis and outpaced the Street estimates of $0.89 per share. Revenues jumped 64% to $460.1 million, topping analysts’ expectations of $414.23 million.

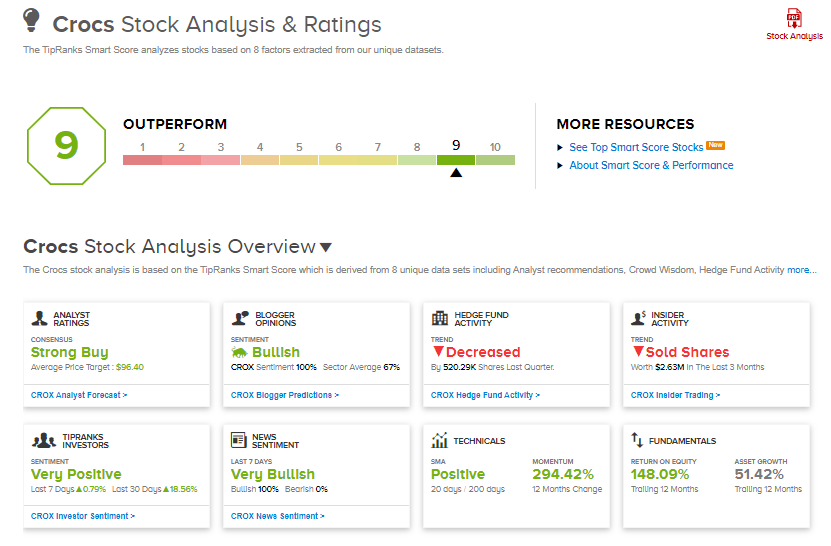

The company’s direct-to-consumer increased 93.3%, while wholesale revenues were up 50.1%. Additionally, digital sales grew 75.3%, while the Asia region recorded growth of 26.2%. (See Crocs stock analysis on TipRanks)

Crocs CEO Andrew Rees said, “Demand for the Crocs brand is stronger than ever with expected 2021 revenue growth of 40% to 50%…We have raised full year guidance as we continue to see consumer demand for our product accelerate globally.”

For 2Q, the company projects revenue to grow by 60%-70% year-over-year.

On April 23, Pivotal Research analyst Mitch Kummetz reiterated a Buy rating and a price target of $100 (17.9% upside potential) on the stock.

Crocs shares have exploded 261% over the past year, while the stock still scores a Strong Buy consensus rating, based on 4 Buys versus 1 Hold. That’s alongside an average analyst price target of $96.40, which implies 13.6% upside potential to current levels.

On top of this, Crocs scores a 9 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Amazon’s AWS Partners With DISH Network

Salesforce Aids Sonos In Digital Transformation

Lam Research’s 4Q Guidance Tops Estimates After 3Q Beat