Shares in Coty (COTY) jumped 18% as it appointed its chairman Peter Harf as CEO to help spearhead a strategic turnaround plan of its business. As part of the plan, the indebted cosmetics maker struck a deal to sell a majority stake in its retail and hair business to buyout firm KKR & Co. (KKR).

Investors welcomed the news as the stock surged 18% to $4.28 in midday U.S. trading after plunging almost 70% since the beginning of the year.

In his new role, Harf will be part of a new three-person Executive Committee to make sure that Coty takes the right steps to become a more profitable company and drive improvements across the business.

Under the agreement with KKR, the cosmetics maker will sell a 60% stake in brands including Wella, Clairol, and OPI, in a deal valued at $4.3 billion. In addition, KKR will invest $1 billion directly into Coty through the issuance of convertible preferred shares.

Coty said that the sale of a majority interest in the professional and retail hair business will simplify its portfolio and allow it to focus on its core prestige and mass beauty businesses.

Excluding the Wella business, Coty is targeting a net reduction in fixed costs of about $600 million in cash over the next 3 years, equating to 25% of its pro forma fixed cost base. The one-off costs associated with this program are estimated at $500 million.

Wells Fargo analyst Joe Lachky maintained a Hold rating on the stock with a $5 price target saying he sees “few positive catalysts until channel disruption normalizes and visibility into stabilization of the top-line emerges”.

“Positively, COTY was able to get a deal done with a strong financial partner at an attractive multiple on pre-COVID financials (12.3x FY19 EBITDA),” Lachky wrote in a note to investors. “That said, we still estimate the transaction will be dilutive, even inclusive of new cost savings.”

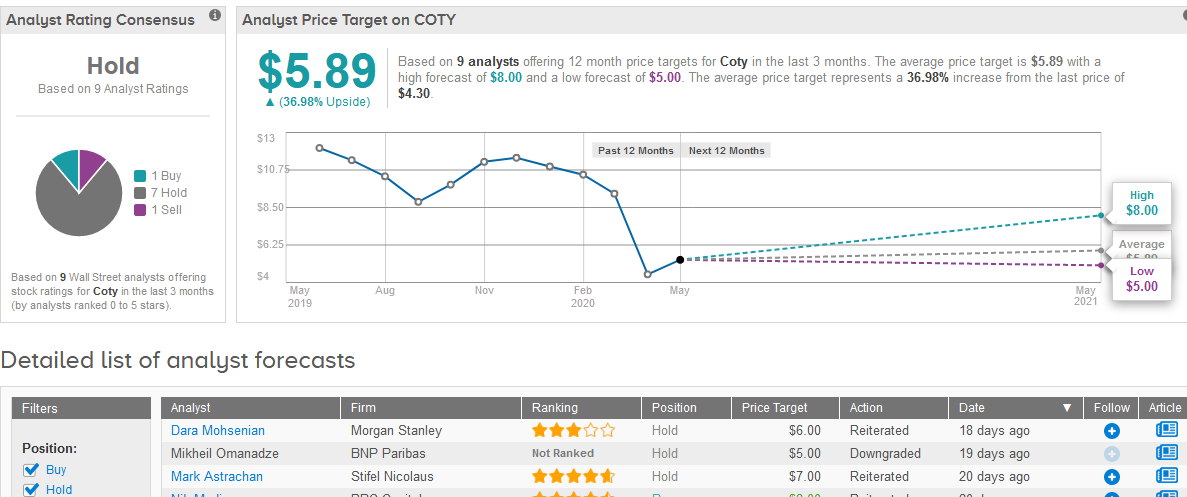

Overall, Wall Street analysts are sitting on the fence when it comes to Coty stock. The Hold consensus consists of 7 Hold ratings, 1 Sell and 1 Buy rating. Following the sharp share plunge this year, the $5.89 average analyst price target implies 37% upside potential over the coming 12 months. (See Coty stock analysis on TipRanks).

Related News:

KKR Joins $3.3 Billion Bid To Acquire Spanish Telecom Carrier Masmovil

Amazon’s Jeff Bezos Invests In UK Freight Startup Beacon

KKR Invests $1.5 Billion in Reliance’s Jio Platforms In Biggest Deal In Asia