Canopy Growth (WEED) reported a smaller loss in the fourth quarter of 2021 than in the prior-year quarter, but still missed analyst expectations as lockdowns restricted sales. Shares fell more than 1% in early trading Tuesday.

The cannabis company sells a wide range of products including cannabis-infused beverages, edibles, dried flowers, and vapes.

Net revenue came in at C$148.4 million for Q4 2021, an increase of 38% year-on-year, driven by a growing demand from customers using cannabis products for entertainment during lockdowns. Analysts expected Canopy to post revenue of C$151.77 million for the quarter.

Meanwhile, net loss for the quarter ended March 31, 2021, narrowed to C$617 million from C$1.33 billion a year ago, thanks to lower costs and higher demand. On a per-share basis, Canopy posted a loss of C$1.85 per share, higher than consensus estimates for a loss of C$0.26. Meanwhile, Adjusted EBITDA loss in Q4 2021 narrowed by C$8 million to C$94 million thanks to lower operating expenses and higher sales.

For FY 2021, net revenue increased 37% year-on-year to C$546 million driven by double-digit growth across international and Canadian cannabis markets as well as in other consumer products businesses.

Net loss for the full year widened by C$283 million to C$1.7 billion, while Adjusted EBITDA loss narrowed by C$102 million to C$340 million.

Canopy Growth CFO Mike Lee said, “We made tremendous progress improving our supply chain and right-sizing our manufacturing footprint, bringing supply and demand into balance. Our cost savings program is on track to deliver C$150-C$200 million of savings within the next 18 months, and we remain committed to our path to profitability by the end of Fiscal 2022, while continuing to invest in an organization that is focused on insights, innovation and gaining momentum in the U.S. market.”

Canopy ended the quarter with C$2.3 billion in cash and short-term investments, C$0.3 billion more than in FY 2020. (See Canopy Growth stock analysis on TipRanks)

Following the results, MKM Partners analyst William Kirk maintained a Buy rating on WEED and a C$55.00 price target for 83% upside potential.

Kirk stated, “We believe U.S. legislative potential is no longer reflected in Canopy valuation, leaving upside should there be any progress from Senator Schumer or the Republican-sponsored bill.”

Overall, WEED scores a Hold rating among Wall Street analysts based on 2 Buys, 5 Holds, and 1 Sell. The average analyst price target of C$39.28 implies 31% upside potential to current levels.

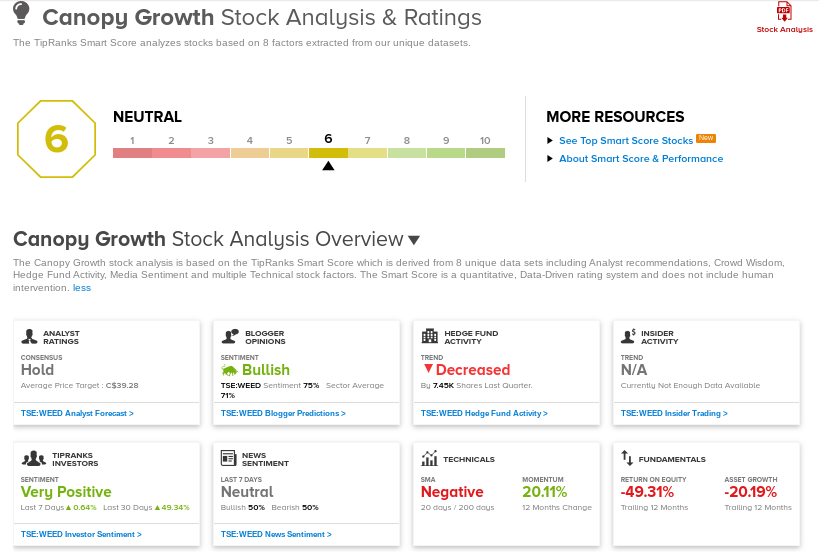

TipRanks’ Smart Score

WEED scores a 6 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock returns are likely to be in line with the overall market.

Related News:

Canopy Growth Earnings Preview: Here’s What to Watch Out For

Aurora Cannabis and Grow Group Extend Partnership

Canopy Growth Partners With Southern Glazer’s Wine & Spirit To Distribute CBD Beverages; Shares Jump 4.5%