Canadian Western Bank (CWB), a Canadian bank based in Edmonton, Alberta, reported better-than-expected profits in its fourth quarter.

Earnings & Revenue

Earnings available to common shareholders came in at C$90 million (C$1.01 per diluted share) in Q4 2021, compared with C$63.4 million (C$0.73 per diluted share) in Q4 2021. (See Analysts’ Top Stocks on TipRanks)

On an adjusted basis, CWB earned C$1.03 per share in the fourth quarter, up 37% from C$0.75 per share a year ago.

Analysts on average expected earnings of C$0.86 per share.

The company said the allowance for impaired loans stood at C$39 million, up from C$34 million last year.

Meanwhile, revenue was C$260.6 million, up 10.1% from C$236.6 million in the prior-year quarter.

Management Commentary

CWB Ppesident and CEO Chris Fowler said, “Our momentum will continue for the year ahead, and we expect to deliver double-digit growth of loans and branch-raised deposits. It’s an exciting time at CWB as we continue to invest in our capabilities and improve our full-service client experience through enhancements to our in-person and digital channels.

“We expect to deliver pre-tax, pre-provision income growth in the mid to high-single digits next year based on strong revenue growth balanced with the significant investments we’ll continue to make in our capabilities to support higher levels of full-service client growth for the years to come.”

Wall Street’s Take

On November 30, BMO Capital analyst Sohrab Movahedi maintained a Hold rating on CWB and a C$42 price target. This implies 18.6% upside potential.

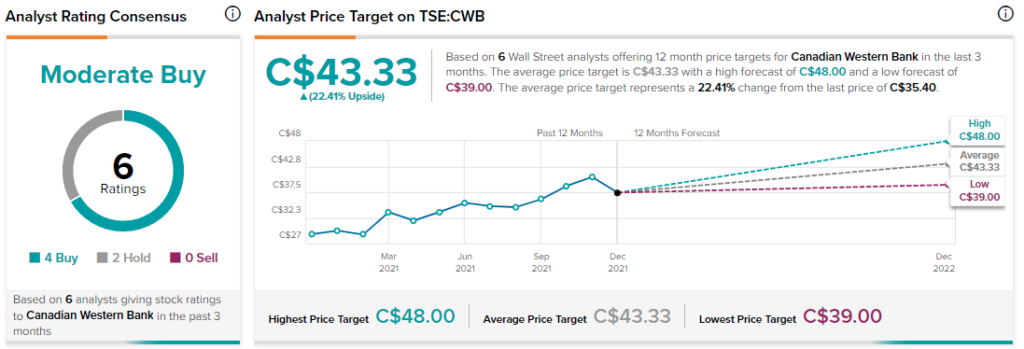

Overall, CWB scores a Moderate Buy rating among Wall Street analysts based on four Buys and two Holds. The average Canadian Western Bank price target of C$43.33 implies 22.3% upside potential to current levels.

Related News:

CIBC Q4 Profit Rises 42%, Dividend Raised

National Bank Q4 Profit Misses Estimates, Dividend Raised

TD Bank Posts Better-Than-Expected Q4